Skip to content

Relevant for GS Paper 3 & Essay:-

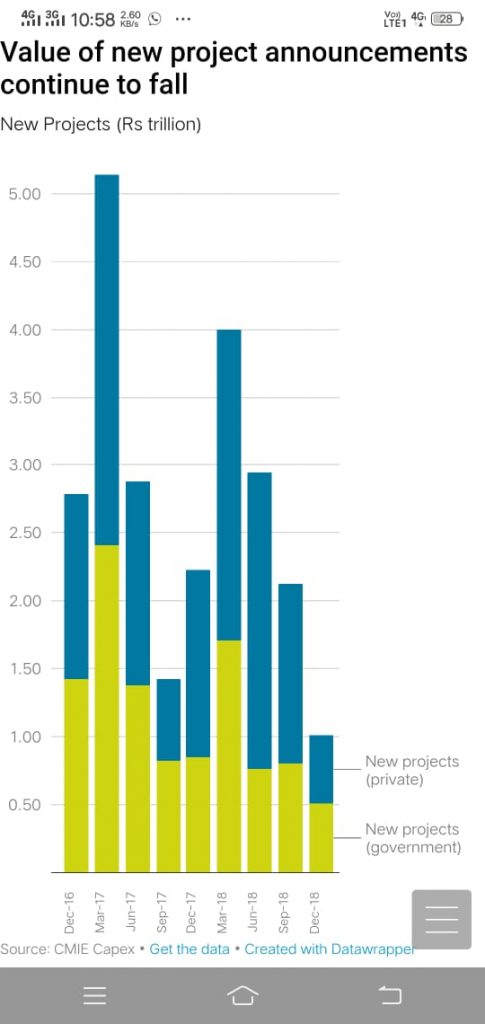

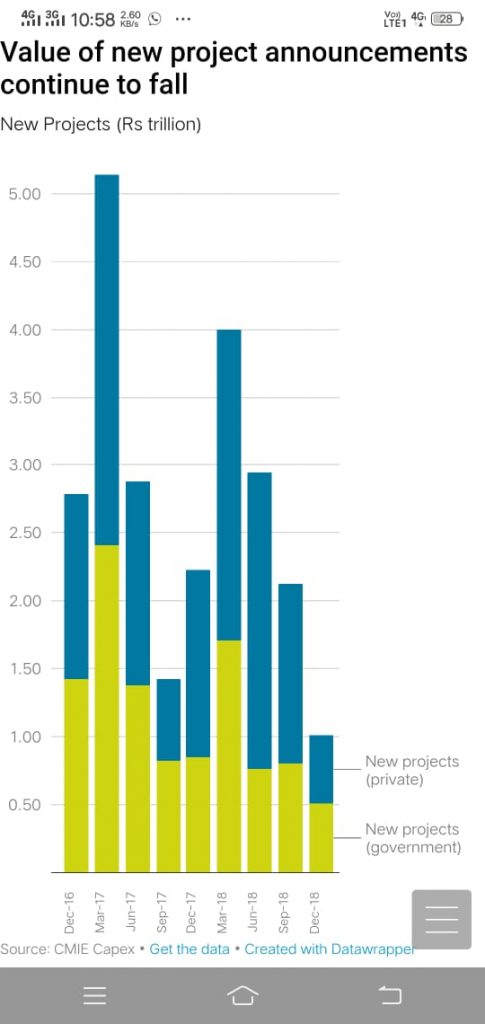

- Mumbai: Dashing hopes of a quick economic turnaround, investments in the just-ended December quarter fell to a 14-year-low, fresh data from the project-tracking database of the Centre for Monitoring Indian Economy (CMIE) shows. Indian companies announced new projects worth ₹1 trillion in the December quarter, 53% lower than what was announced in September quarter, and 55% lower than the year-ago period (chart 1).

Value of new project announcements continue to fall:

- The sequential decline in capex announcements was led by a sharp decline in new project announcements by the private sector. New private sector projects fell 62% in the just-ended December quarter compared with the September quarter, and 64% compared with the December quarter of FY18

- New public sector projects also declined compared with the September quarter of FY19. Fresh investment announcements in the public sector fell 37% on quarter and 41% on year to ₹50,604 crore—the lowest level since December 2004.

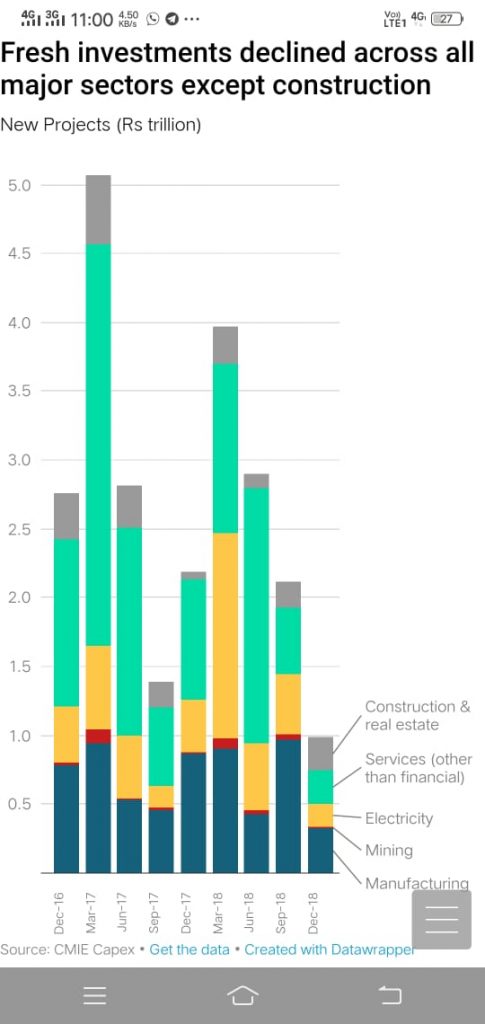

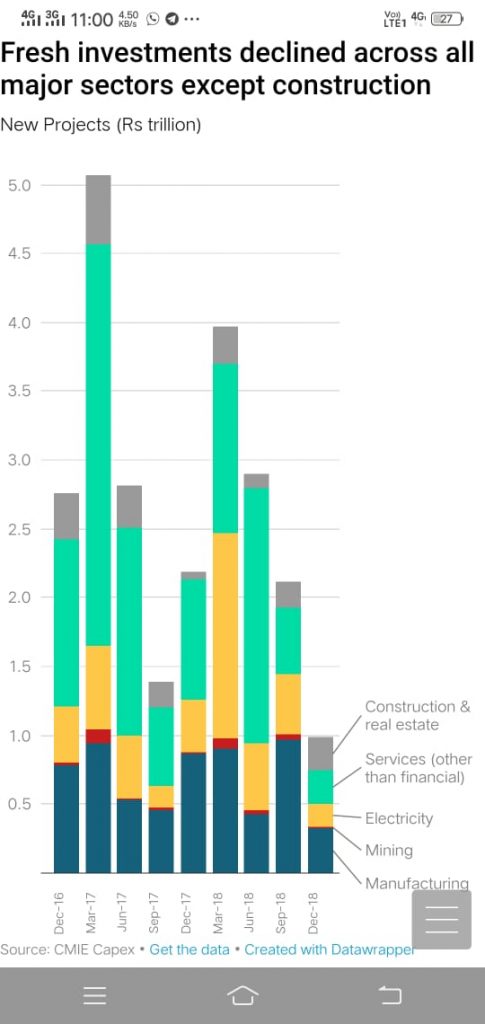

- The decline in fresh investments was across the board, with all major sectors witnessing a fall.

- The only exception was the construction sector, which had a low base to begin with, and which saw only a marginal improvement in the December quarter

Fresh investments declined across all major sectors except construction:-

- The continuing overhang of bad debt, rising policy uncertainties ahead of the polls, and the lack of much progress in unclogging the pipeline of stalled projects seems to be weighing down the animal spirits of Indian industry.

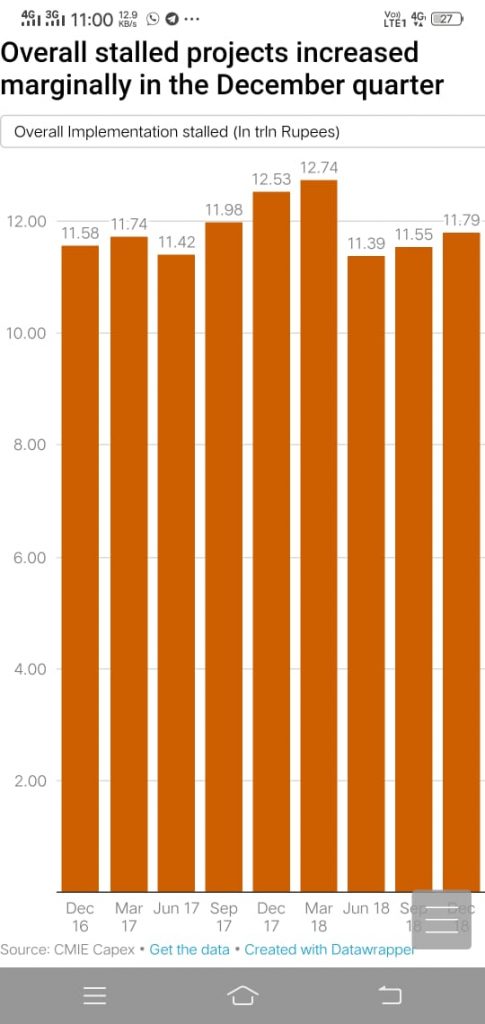

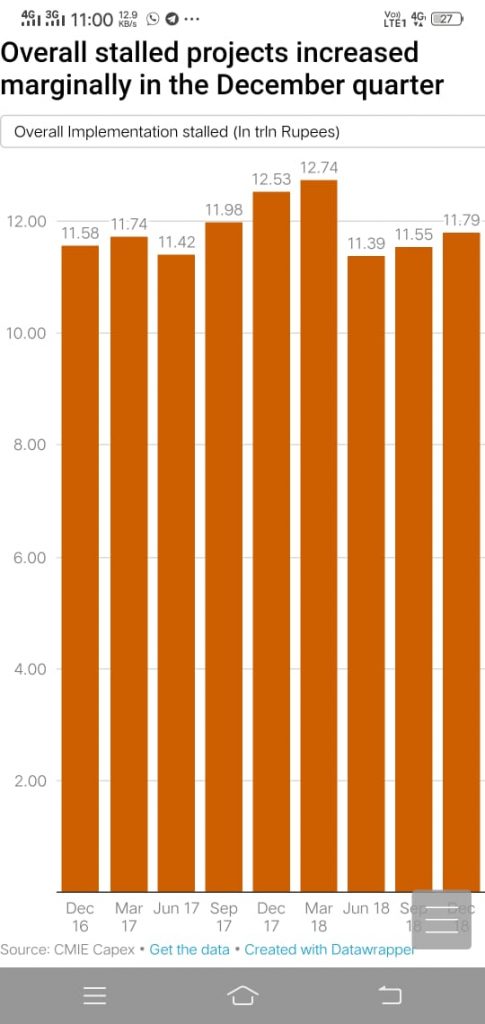

- The CMIE data shows that the value of stalled projects increased marginally in the December quarter even as the rate of stalling remained the same.

- Stalling rate is calculated as a percentage of the total projects under implementation so that the values are comparable across time.

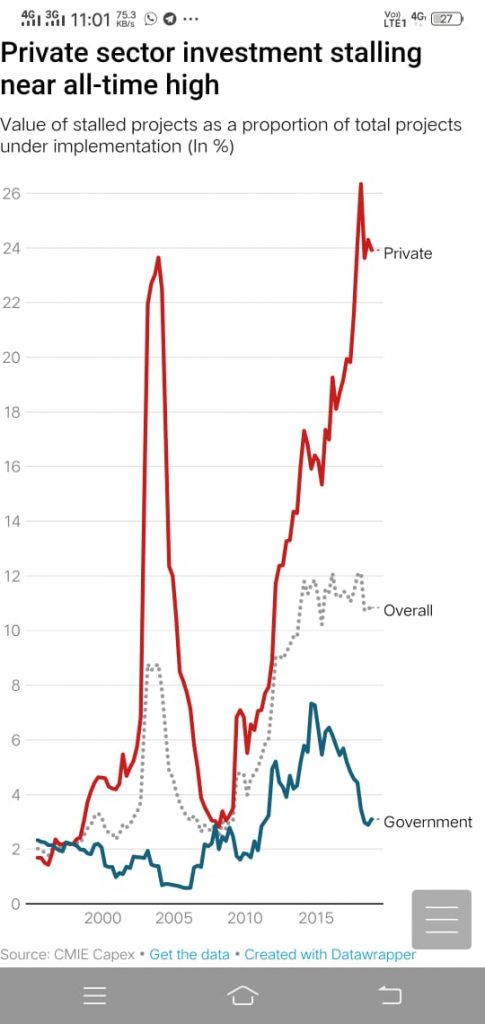

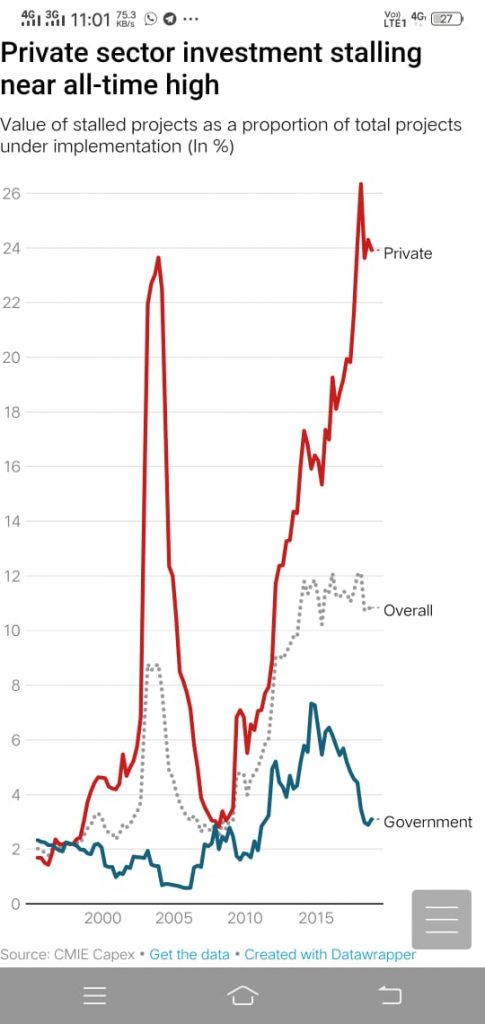

- The private sector stalling rate is hovering near its record high at 24%, data shows. The overall stalling rate is lower at 11%, partly because of the recent improvement in stalling rates in public sector projects (charts 3 and 4).

Overall stalled projects increased marginally in the December quarter:-

Private sector investment stalling near all-time high:-

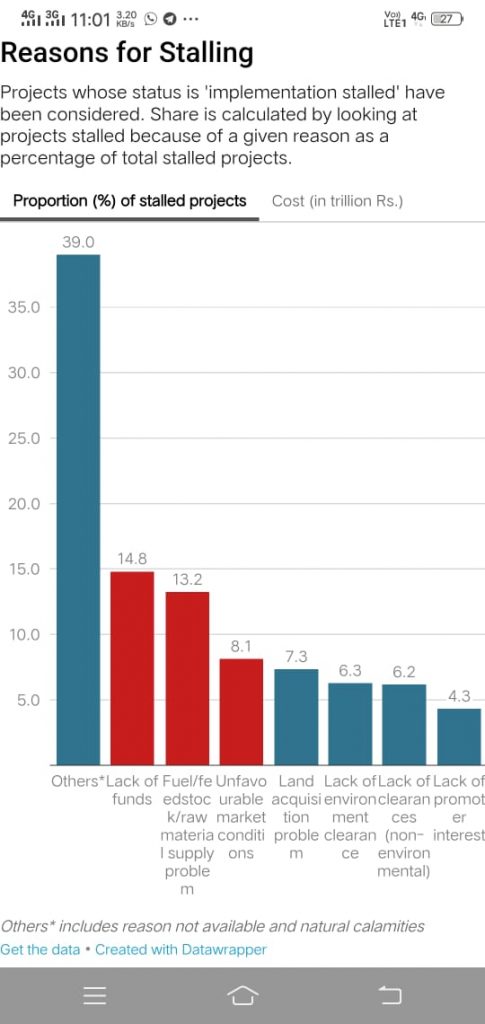

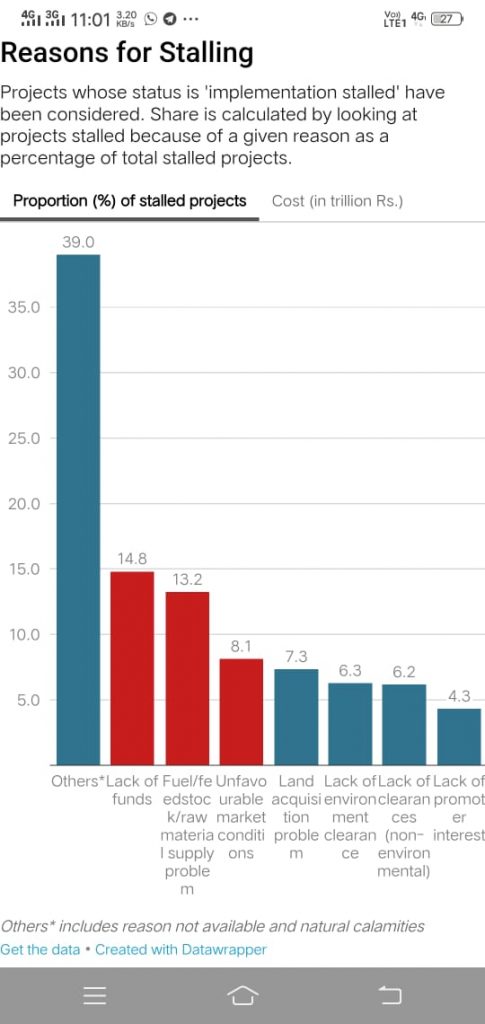

- The power and manufacturing sectors remained the worst affected by stalling. The power sector accounted for 35.4% of all stalled projects, while manufacturing accounted for 29.2%. The biggest reasons for stalling are lack of funds, problems with fuel and raw material, and unfavourable market conditions. Among the major reasons for stalling, ‘lack of funds’ has emerged as the biggest reason in recent quarters, suggesting that under-financed banks and stressed corporations are finding it increasingly difficult to finance their projects (chart 5).

Reasons for Stalling:-

- Projects whose status is ‘implementation stalled’ have been considered. Share is calculated by looking at projects stalled because of a given reason as a percentage of total stalled projects.

- The declining trend in investments does not bode well for the economy in the New Year. The lack of an investment recovery and the high rates of stalling also reflect poorly on the incumbent government which rode to power in 2014 promising to end an era of policy paralysis, and to reinvigorate the investment cycle.

- As elections to the Lok Sabha draw nearer, rising political uncertainty is likely to weigh down investment sentiment even further as investors adopt a wait-and-watch approach. Rise in populism is another growing threat. Already, the rise in farm loan waivers seems to have prompted state governments to cut back on capex spending, a trend that could intensify in the coming months.