Why in news?

• Union Ministry of Finance to impose an equalisation levy of 2% on e-commerce supplies and services from 1st April.

About:

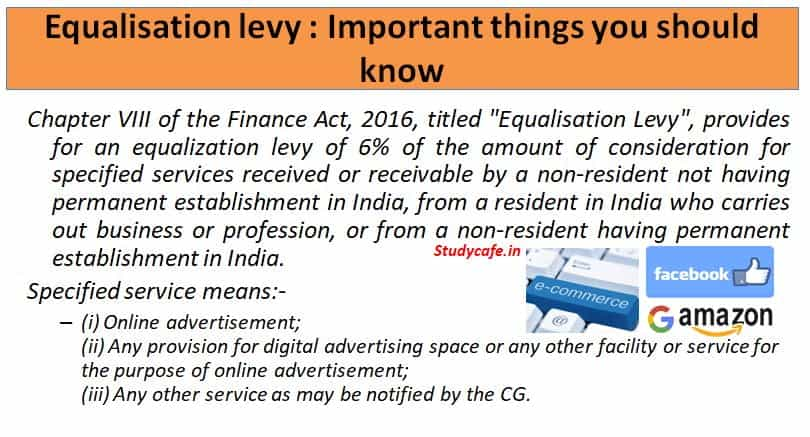

• Equalisation Levy was first introduced by Finance Act, 2016, at the rate of 6 per cent on payments for digital advertising services received by non-resident companies without a permanent establishment (PE) in India, if these exceeded Rs 1 lakh a year.

• It is a direct tax, which is withheld at the time of payment by the service recipient.

• The Budget 2020-21 has expanded its scope to include consideration received by non-resident e-commerce operators for e-commerce supply and services. The rate applicable has been set at 2 per cent effective from April 1, 2020.

• Digital offerings of non-residents such as online books/online games/online gaming services (under specified circumstances) seem to come under the purview of the expanded equalisation levy.

• The first instalment of payment became due on July 7.

Significance:

• The purpose of the equalisation levy is to ensure greater competitiveness, fairness, reasonableness and exercise the ability of governments to tax businesses that have a close nexus with the Indian market through their digital operations.

Concerns:

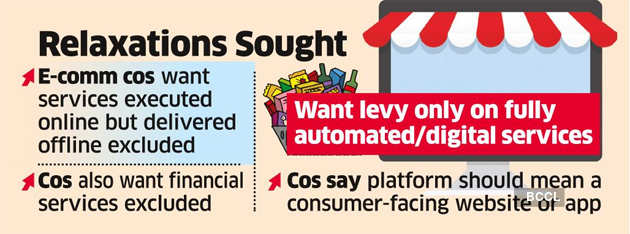

• The levy has several issues which include very wide coverage (even non-e-commerce companies could be covered), lack of clarity on how consideration needs to be determined especially in cases where the income is less as compared to the transactions facilitated by the non-resident e-commerce operators.

• Even transactions between non-residents are covered and this seems to be an extraterritorial overreach along with practical difficulty in implementation.

Way forward:

• There should be a distinction between digital goods/digital services on one hand and goods and services supplied using the digital medium as a mode of delivery or for transacting.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS. https://triumphias.com/pages-all-courses.php