Carbon Markets

(Relevant for General Studies Paper Prelims/Mains)

(Reference The Hindu & Indian Express)

Carbon Markets

As the effects of global warming intensify, there is a pressing need to adopt measures that mitigate the release of greenhouse gases (GHGs).

One of the various solutions being implemented or explored to address this urgency is the establishment of a dynamic carbon trading network.

Carbon markets

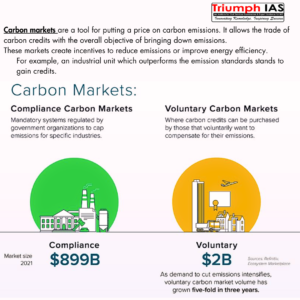

carbon markets function as a mechanism for assigning a value to carbon emissions, creating trading platforms where carbon credits or allowances can be bought and sold.

A carbon credit, following United Nations guidelines, represents one metric ton of carbon dioxide that has been either removed, reduced, or sequestered from the atmosphere and can be traded.

Carbon allowances or caps, on the other hand, are determined by nations or governments based on their emissions reduction objectives.

The formal initiation of carbon trading dates back to 1997 under the United Nations’ Kyoto Protocol.

There are primarily two categories of carbon markets in existence today:

- Voluntary Markets: In these markets, emitters acquire carbon credits to offset the emission equivalent of one tonne of CO2 or other greenhouse gases. These carbon credits originate from activities that decrease CO2 levels in the atmosphere, such as afforestation. Within the voluntary market, corporations seeking to compensate for their unavoidable greenhouse gas emissions purchase carbon credits from entities engaged in projects that lower, capture, remove, or prevent emissions. For instance, airlines in the aviation sector might buy carbon credits to offset the carbon emissions generated by their flights. In voluntary markets, credits are validated by private firms in accordance with recognized standards.

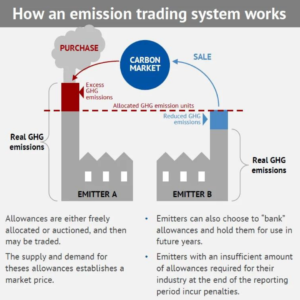

- Compliance Markets: These markets are established through policies at national, regional, or international levels and are subject to official regulations. Compliance markets generally operate under the “cap-and-trade” principle, with the European Union (EU) being a prominent proponent of this approach.

Status of the Carbon Market in India

In India, there is a plan underway at the national level to establish the Indian Carbon Market (ICM) through the creation of a comprehensive framework aimed at reducing carbon emissions within the country.

Recently, the Union government notified the draft framework for the Indian Carbon Credit Scheme 2023. The responsibility of developing the Carbon Trading Scheme has been entrusted to the Bureau of Energy Efficiency, which operates under the Ministry of Power, in collaboration with the Ministry of Environment, Forest & Climate Change.

The ICM is expected to yield several advantages:

- Emission Reduction: It will play a pivotal role in helping India achieve its target of reducing the emissions intensity of its GDP by 45% by 2030 in comparison to the 2005 levels, aligning with its global climate commitments.

- Decarbonization: The ICM will contribute significantly to the process of decarbonization in commercial and industrial sectors, in line with India’s objective of achieving net-zero emissions by 2070.

- Energy Transition: The ICM’s comprehensive scope will encompass various potential energy sectors within the country, thus promoting a transition towards cleaner energy sources.

- Emission Targets: It will facilitate the development of greenhouse gas (GHG) emissions intensity targets and benchmarks that are synchronized with the country’s domestic emissions trajectory, aligning with climate objectives.

- Flexibility for Companies: While being subject to regulation, the ICM will offer flexibility to companies operating in challenging segments to enhance their efforts in reducing GHG emissions by utilizing carbon market credits.

- Awareness and Innovation: Additionally, it is expected to raise awareness, induce transformative changes, and encourage innovation in industries that are traditionally difficult to decarbonize.

- Attracting Finance and Technology: The ICM could serve as an attractive platform for securing financing and technology for sustainable projects that have the potential to generate carbon credits, further bolstering efforts to combat climate change.

Benefits of Carbon Markets

- Financial Incentives: Carbon markets establish a system of financial incentives where entities are allocated emission limits and have the ability to trade emission permits. This motivates companies to reduce emissions below their allocated limits while penalizing those exceeding them.

- Cost-Effective Reductions: Carbon markets prioritize the cost-effective reduction of emissions. Companies that can achieve emission reductions more efficiently and at a lower cost are encouraged to do so, resulting in overall emission reductions with a reduced economic burden.

- Business Flexibility: Carbon markets offer businesses flexibility in choosing how to curtail emissions. They can opt to invest in cleaner technologies, enhance energy efficiency, or acquire carbon credits from emission reduction projects located elsewhere. This flexibility allows for a diverse array of emission reduction strategies.

- Promotion of Clean Technologies: These markets stimulate the advancement and adoption of cleaner technologies and sustainable practices. Companies are incentivized to innovate and invest in technologies that minimize emissions to lower their compliance expenses in the carbon market.

- Support for Sustainability: Carbon markets generate funding for sustainable initiatives aimed at emissions reduction, including projects related to renewable energy, afforestation, reforestation, and energy efficiency. These projects earn carbon credits, which can be traded in the market, attracting investment.

- Alignment with Climate Goals: Carbon markets can be customized to align with a country’s climate objectives and international commitments, assisting nations in achieving their emission reduction targets, as outlined in agreements like the Paris Agreement. They create a mechanism for monitoring and mitigating emissions.

- Transparency & Accountability: Participation in carbon markets necessitates accurate measurement and reporting of emissions. This fosters increased transparency and accountability in monitoring and reducing greenhouse gas emissions.

- Revenue Generation: Governments can generate revenue through carbon markets by auctioning emission permits or imposing carbon taxes. This revenue can be reinvested in sustainability initiatives or allocated for various public purposes. Moreover, companies have the opportunity to earn revenue by selling carbon credits.

- For instance, in the first quarter of 2021, Tesla, the electric vehicle manufacturer, generated USD 518 million in revenue by selling carbon credits to traditional automakers

Challenges Before Carbon Markets

- Double Counting of Emissions Reductions: This issue arises when the same emission reduction is claimed by multiple entities or through multiple systems. Such practices can undermine the environmental credibility and trustworthiness of carbon markets.

- Quality and Authenticity of Climate Projects: Ensuring the reliability and authenticity of climate projects presents the challenge of assessing their level of additional impact, measurability, verifiability, permanence, and the prevention of emissions shifting.

- Poor Market Transparency: This pertains to the uncertainty surrounding the availability and accessibility of information concerning the supply and demand of carbon credits or offsets. It also includes information regarding their pricing, transactions, and overall impact.

- Greenwashing: Greenwashing involves the deceptive practice of using carbon credits or offsets to create a false or misleading image of environmental responsibility, all while failing to actually reduce emissions or alter business practices. This can erode public trust and divert resources away from more effective climate mitigation measures.

- Regulatory Uncertainty: Regulatory uncertainty relates to the lack of clarity or consistency in the policies and regulations governing carbon markets, both on national and international levels. This uncertainty can pose risks and barriers for market participants and potential investors.

- For example, in India, there is a debate concerning whether the Ministry of Power or the Ministry of Environment is the appropriate authority to regulate the carbon credits trading scheme.

Steps which can be taken to Overcome the Challenges of Carbon Markets

- Establishing a unified taxonomy and terminology for carbon credits and offsets, alongside a standardized accounting framework, to prevent the duplication of emissions reductions.

- Defining precise and credible quality standards and verification mechanisms for climate projects generating carbon credits or offsets. These standards should be grounded in principles such as additional impact, measurability, permanence, and the avoidance of emissions leakage.

- Improving transparency and disclosure within the market by providing dependable and timely data and reporting on the availability and demand for carbon credits or offsets, including information on their pricing, transactions, and overall effects.

- Implementing measures to deter and penalize greenwashing, which includes establishing unambiguous and enforceable regulations and guidelines for making statements and communicating about carbon credits or offsets. Public awareness and scrutiny should also be ensured.

- Streamlining and integrating various carbon market systems on national, regional, and international scales, while establishing connections and synergies with other policy tools and initiatives.

As the country moves steadily towards a net-zero world, decarbonising industrial activity will be critical. It is here that industry leaders in carbon management solutions and clean energy transition can play a pivotal role in facilitating the transition towards a net-zero future by helping the nation switch from fossil fuel or legacy technologies to clean energy systems.

Related Blogs…

|

|

Frequently Asked Questions:

Question 1: What is the social implication of carbon markets?

Answer: Carbon markets can influence social behaviors and expectations by putting a price on carbon emissions, thereby encouraging companies and individuals to adopt more sustainable practices. They also highlight social inequalities, as wealthier nations and companies can more easily adapt to or offset their emissions, compared to less affluent ones.

Question 2: How do carbon markets contribute to sustainable development?

Answer: Carbon markets incentivize emission reductions and the adoption of clean technologies, directing financial resources towards sustainable projects such as afforestation and renewable energy, thus contributing to the broader goals of sustainable development.

Question 3: What are the challenges of implementing a carbon market in a developing country like India?

Answer: Implementing a carbon market in a developing country poses challenges such as regulatory uncertainty, lack of technical expertise, and the need to balance economic growth with environmental conservation.

Question 4: What role does governance play in the effectiveness of carbon markets?

Answer: Effective governance is essential for setting credible caps on emissions, verifying emission reductions, and penalizing non-compliance, ensuring that carbon markets achieve their intended purpose.

Question 5: What is the concept of “Greenwashing,” and why is it a challenge for carbon markets?

Answer: Greenwashing refers to deceptive practices where companies or entities portray themselves as environmentally responsible without making substantial efforts to reduce emissions. It undermines the credibility of carbon markets and can mislead the public and investors.

GS Related Practices Questions…

To master these intricacies and fare well in the Sociology Optional Syllabus, aspiring sociologists might benefit from guidance by the Best Sociology Optional Teacher and participation in the Best Sociology Optional Coaching. These avenues provide comprehensive assistance, ensuring a solid understanding of sociology’s diverse methodologies and techniques.

Carbon Markets, Greenhouse Gases, Emission Reduction, Kyoto Protocol, India Carbon Market, Voluntary Markets, Compliance Markets, Decarbonization, Sustainable Finance, Climate Policy, Regulatory Challenges, Greenwashing

Why Vikash Ranjan’s Classes for Sociology?

Proper guidance and assistance are required to learn the skill of interlinking current happenings with the conventional topics. VIKASH RANJAN SIR at TRIUMPH IAS guides students according to the Recent Trends of UPSC, making him the Best Sociology Teacher for Sociology Optional UPSC.

At Triumph IAS, the Best Sociology Optional Coaching platform, we not only provide the best study material and applied classes for Sociology for IAS but also conduct regular assignments and class tests to assess candidates’ writing skills and understanding of the subject.

Choose The Best Sociology Optional Teacher for IAS Preparation?

At the beginning of the journey for Civil Services Examination preparation, many students face a pivotal decision – selecting their optional subject. Questions such as “which optional subject is the best?” and “which optional subject is the most scoring?” frequently come to mind. Choosing the right optional subject, like choosing the best sociology optional teacher, is a subjective yet vital step that requires a thoughtful decision based on facts. A misstep in this crucial decision can indeed prove disastrous.

Ever since the exam pattern was revamped in 2013, the UPSC has eliminated the need for a second optional subject. Now, candidates have to choose only one optional subject for the UPSC Mains, which has two papers of 250 marks each. One of the compelling choices for many has been the sociology optional. However, it’s strongly advised to decide on your optional subject for mains well ahead of time to get sufficient time to complete the syllabus. After all, most students score similarly in General Studies Papers; it’s the score in the optional subject & essay that contributes significantly to the final selection.

“A sound strategy does not rely solely on the popular

Opinion of toppers or famous YouTubers cum teachers.”

It requires understanding one’s ability, interest, and the relevance of the subject, not just for the exam but also for life in general. Hence, when selecting the best sociology teacher, one must consider the usefulness of sociology optional coaching in General Studies, Essay, and Personality Test.

The choice of the optional subject should be based on objective criteria, such as the nature, scope, and size of the syllabus, uniformity and stability in the question pattern, relevance of the syllabic content in daily life in society, and the availability of study material and guidance. For example, choosing the best sociology optional coaching can ensure access to top-quality study materials and experienced teachers. Always remember, the approach of the UPSC optional subject differs from your academic studies of subjects. Therefore, before settling for sociology optional, you need to analyze the syllabus, previous years’ pattern, subject requirements (be it ideal, visionary, numerical, conceptual theoretical), and your comfort level with the subject.

This decision marks a critical point in your UPSC – CSE journey, potentially determining your success in a career in IAS/Civil Services. Therefore, it’s crucial to choose wisely, whether it’s the optional subject or the best sociology optional teacher. Always base your decision on accurate facts, and never let your emotional biases guide your choices. After all, the search for the best sociology optional coaching is about finding the perfect fit for your unique academic needs and aspirations.

To master these intricacies and fare well in the Sociology Optional Syllabus, aspiring sociologists might benefit from guidance by the Best Sociology Optional Teacher and participation in the Best Sociology Optional Coaching. These avenues provide comprehensive assistance, ensuring a solid understanding of sociology’s diverse methodologies and techniques. Sociology, Social theory, Best Sociology Optional Teacher, Best Sociology Optional Coaching, Sociology Optional Syllabus.

Best Sociology Optional Teacher, Sociology Syllabus, Sociology Optional, Sociology Optional Coaching, Best Sociology Optional Coaching, Best Sociology Teacher, Sociology Course, Sociology Teacher, Sociology Foundation, Sociology Foundation Course, Sociology Optional UPSC, Sociology for IAS,

Follow us :

🔎 https://www.instagram.com/triumphias

🔎https://www.youtube.com/c/TriumphIAS

https://t.me/VikashRanjanSociology

Find More Blogs

|

Scope of the subject and comparison with other social sciences |

|||

|

|

|

|

Modernity and social changes in Europe |