Relevance: Prelims/Mains: G.S paper III: Indian Economy

Why in news?

The government operationalised the Credit Guarantee Scheme for Subordinate Debt for stressed Micro, Small & Medium Enterprises (MSMEs). It had announced this scheme as part of the Aatma Nirbhar Bharat Package.

The scheme provides liquidity to stressed MSMEs without really burdening them with heavy debt obligations and the banks are guaranteed the loan amount so they don’t have to worry about repayment.

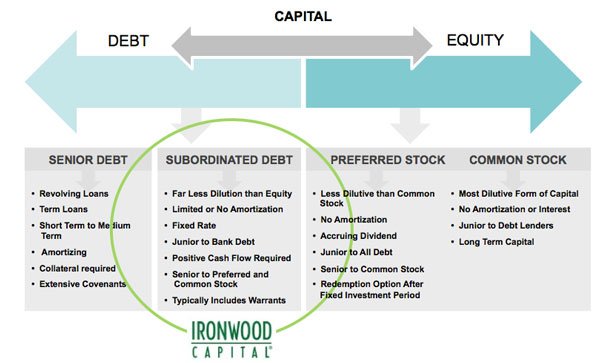

What Is Subordinated Debt?

Subordinated debt (also known as a subordinated debenture) is an unsecured loan or bond that ranks below other, more senior loans or securities with respect to claims on assets or earnings. Subordinated debentures are thus also known as junior securities. In the case of borrower default, creditors who own subordinated debt will not be paid out until after senior bondholders are paid in full.

KEY TAKEAWAYS

- Subordinated debt is debt that is repaid after senior debtors are repaid in full.

- It is riskier as compared to unsubordinated debt and is listed as a long-term liability after unsubordinated debt on the balance sheet.

Understanding Subordinated Debt

Subordinated debt is riskier than unsubordinated debt. Subordinated debt is any type of loan that’s paid after all other corporate debts and loans are repaid, in the case of borrower default. Borrowers of subordinated debt are usually larger corporations or other business entities. Subordinated debt is the exact opposite of unsubordinated debt in that senior debt is prioritized higher in bankruptcy or default situations.

Subordinated Debt: Repayment Mechanics

When a corporation takes out debt, it normally issues two or more bond types that are either unsubordinated debt or subordinated debt. If the company defaults and files for bankruptcy, a bankruptcy court will prioritize loan repayments and require that a company repay its outstanding loans with its assets. The debt that is considered lesser in priority is the subordinated debt. The higher priority debt is considered unsubordinated debt.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS. https://triumphias.com/pages-all-courses.php