Why in news?

• The Supreme Court (SC) has ruled that all co-operative banks in the country could make use of the SARFAESI Act to make recovery against defaulting persons.

Recent Ruling:

• The SC held that all such cooperative banks involved in the activities related to banking are covered within the meaning of ‘banking company’.

• The cooperative banks cannot carry on any activity without compliance of the provisions of the Banking Regulation Act, 1949 and any other legislation applicable to such banks relatable to banking,” the five-judge bench said.

• In the past, there have been calls to notify non-scheduled urban cooperative banks as ‘financial institutions’ so they could make use of the Insolvency and Bankruptcy Code, 2016 (IBC) to recover money.

About SARFAESI Act:

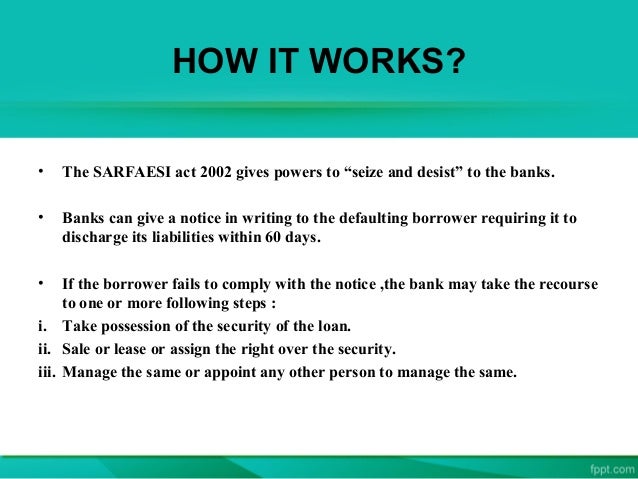

• SARFAESI (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest) Act allows banks and other financial institution to auction residential or commercial properties (of Defaulter) to recover loans.

• The Act provides three alternative methods for recovery of non-performing assets, namely:

(1) Securitisation, (2) Asset Reconstruction and (3) Enforcement of Security without the intervention of the Court.

• The first asset reconstruction company (ARC) of India, ARCIL, was set up under this act.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS. https://triumphias.com/pages-all-courses.php

Very good information with short and simple manner