Why in News?

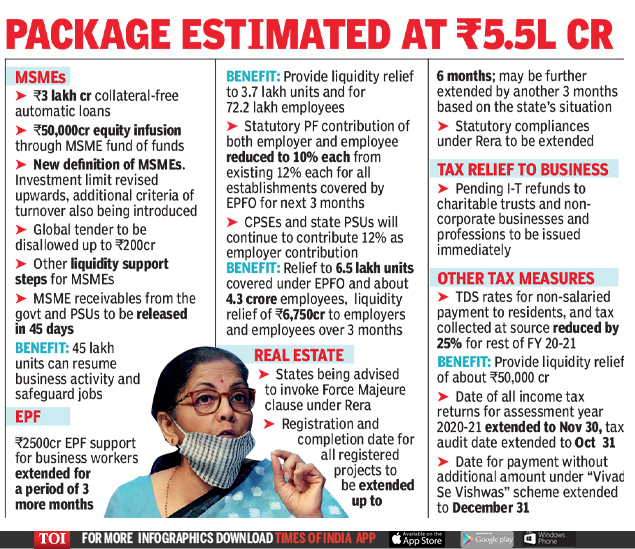

Recently, the Reserve Bank of India (RBI) cleared a loan restructuring scheme for borrowers who are under stress because of the pandemic.

- Key sectors, such as micro, small and medium enterprises (MSMEs), hospitality, aviation, retail, real estate and auto, which are facing a liquidity crunch, will benefit from this scheme.

Who are the Beneficiaries?

- This one-time restructuring window is available across sectors and is expected to provide relief to companies that were servicing loan obligations on time but could have found it difficult after March, as the pandemic affected their revenues.

- Only those companies and individuals whose loans accounts are in default for not more than 30 days as on March 1, 2020, are eligible for one-time restructuring.

- For corporate borrowers, banks can invoke a resolution plan till December 31, 2020, and implement it till June 30, 2021, and such loan accounts should continue to be standard till the date of invocation.

- For personal loans, the resolution plan can be invoked till December 31, 2020, and will be implemented within 90 days thereafter and this will be for accounts classified as standard, but not in default for more than 30 days as on March 1.

- Companies that were already in default for more than 30 days as on March 1 cannot avail this facility.

Implementation:

- The RBI has set up a five-member expert committee headed by K V Kamath, former Chairman of ICICI Bank, which will make recommendations on the financial parameters required.

- The panel will recommend the sector-specific benchmark ranges for such parameters to be factored into each resolution plan for borrowers with aggregate exposure of Rs 1,500 crore or above at the time of invocation.

- The committee will undertake a process validation of resolution plans for accounts above a specified threshold. The RBI will notify this along with modifications in 30 days.

- The RBI will have the last word on who will be eligible and the parameters.

How this will impact the banks?

- The banks will be able to check the rise in non-performing assets (NPAs) to a great extent.

- It will not bring down the NPAs from the present levels but bad loans of close to Rs 9 lakh crore will remain within the system. Banks will have to maintain an additional 10% provisions against post-resolution debt.

- Lenders that do not sign the Inter Creditor Agreement (ICA) within 30 days of invocation of the plan will have to create a 20% provision and this will be a burden for banks.

- The banks won’t face much of a problem in working out individual resolutions plans: they will have to tackle only borrowers who were in stress after the pandemic hit.

Safeguard measures:

- The RBI has built-in safeguards in the resolution framework this time to ensure it does not lead to ever-greening of bad loans as in the past.

- Restructuring of large exposures will require independent credit evaluation done by rating agencies and process validation by the Kamath-led expert committee.

- For personal loans, there will be no requirement for third party validation by the expert committee, or by credit rating agencies, or need for ICA.

- The RBI has said that the term of loans under resolution cannot be extended by more than two years and in the case of multiple lenders to a single borrower, banks need to sign an ICA.

- To mitigate the impact of expected loan losses, banks need to make a 10% provision against such accounts under resolution and for banks not willing to be part of the ICA, a penal provision of 20% has been specified.

How it is different from past schemes?

- The earlier restructuring schemes did not have any entry barrier, unlike the current scheme that is available only for companies facing COVID-related stress, as identified by the cut-off date of March 1.

- Strict timelines for invocation of resolution plan and its implementation have been defined in the scheme, unlike in the past when this was largely open-ended.

- The structuring of the scheme makes the signing of the ICA largely mandatory for all lenders once the resolution plans have been majority-voted for, otherwise, they face twice the amount of provisioning required.

- Independent external evaluation, process validation and specific post-resolution monitoring are further safeguards.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS.