Relevance: Prelims: Economy

Why in news?

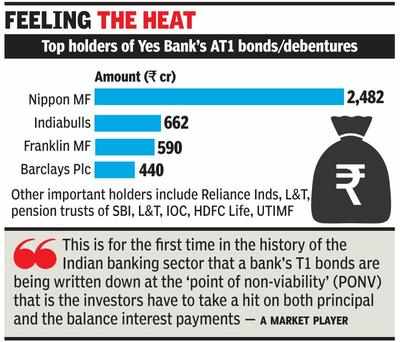

The RBI reconstruction plan for Yes Bank puts to risk nearly Rs 9,000 crore worth of AT-1 bonds. The bondholders have reportedly postponed their legal challenge to the RBI’s scheme.

About:

- AT-1, short for Additional Tier-1 bonds, are a type of unsecured, perpetual bonds that banks issue to shore up their core capital base to meet the Basel-III norms.

- As per RBI rules based on the Basel-III framework, AT-1 bonds have principal loss absorption features, which can cause a full write-down or conversion to equity on breach of a pre-specified trigger of common Tier 1 capital ratio falling below 6.125 per cent.

Key highlights:

- AT-1 bonds have several unusual features:

- One, these bonds are perpetual and carry no maturity date. Instead, they carry call options that allow banks to redeem them after five or 10 years.

- Two, banks issuing AT-1 bonds can skip interest payouts for a particular year or even reduce the bonds’ face value witthreshold levels.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS. https://triumphias.com/pages-all-courses.php