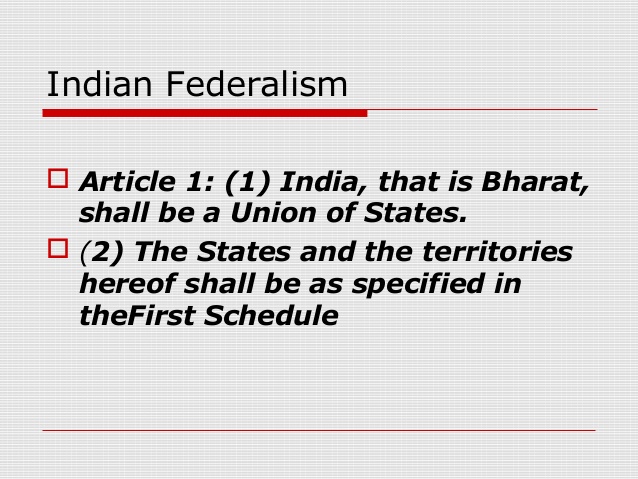

Relevance: Mains: G.S paper II: Polity: Constitution: Federalism

Context:

- The ongoing budget season is the right time to carry out a realistic assessment. After the Union budgetRe for 2020-21 was presented on 1 February, at least four state governments have released their budgets: Odisha, Tamil Nadu, Rajasthan and Uttar Pradesh.

Background:

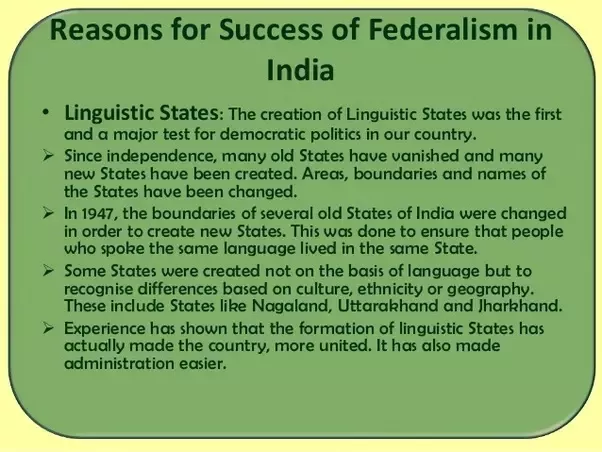

- Despite being a functional democracy for more than seven decades, India cannot ignore the role of the parties in power while reviewing the dynamics between various pillars of governance.

• A dispassionate analysis that focuses merely on requirements and performance is unlikely to reveal the full picture.

• Union finance minister highlighted the need for greater Centre-state cooperation to implement agricultural reforms, strengthen medical education, promote tourism, and attract investments.

State budgets cover these issues:

- The Odisha government follows a practice of presenting its budget in two parts, with the first part dedicated to agriculture and allied activities.

• To promote tourism, the Rajasthan government has proposed implementing a policy on the Ease of Travelling.

• The Uttar Pradesh government is in the process of establishing 21 new medical colleges and a medical university.

• The Tamil Nadu government is likely to launch a new industrial policy shortly that will provide incentives compatible with the goods and services tax regime to attract investors.

Reduced the transfer:

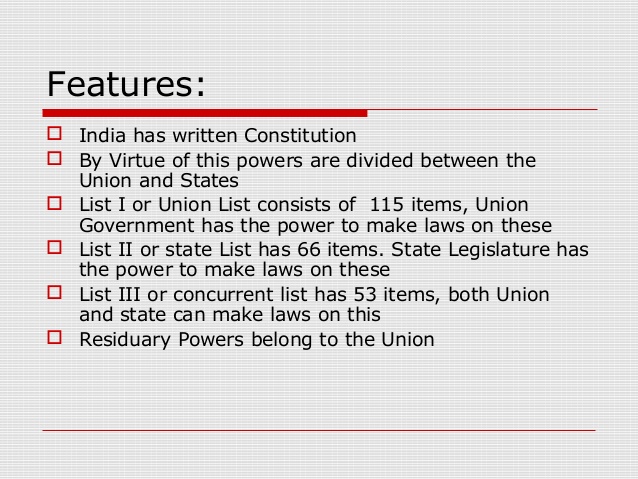

- Under the Union budget, the total estimated transfers to states from the Centre for the ongoing fiscal year have been reduced by around ₹1.41 trillion.

• This is because of a decrease in the estimated transfers to states on account of their share in central taxes and centrally-sponsored schemes.

• The Congress-run Rajasthan government, in its budget, has blamed the Centre for economic mismanagement and the consequent reduction of the state’s share in central taxes by more than ₹10,000 crore.

• It argues that while the Centre has several options of raising funds, such as disinvestment and approaching the Reserve Bank of India, no such option is available to the state.

• The Tamil Nadu budget also points out that the Centre has reduced the state’s share in central taxes for the current fiscal year by around ₹8,000 crore.

• While terming this as unprecedented, it notes that the state government has been able to partially make up for the shortfall by obtaining additional grants from the Centre of around ₹5,000 crore.

• Given that Tamil Nadu is governed by the All India Anna Dravida Munnetra Kazhagam (AIADMK), a strong regional party and a partner of the BJP at the Centre, unlike Rajasthan, it might have been able to negotiate a better deal for itself with the Union government in New Delhi.

• The government of Odisha, in its budget, has also noted that its share in central taxes for the current fiscal year has been reduced by ₹9,000 crore. Still, it has proposed a fund of ₹500 crore to facilitate timely payment of wages under the rural employment guarantee scheme, pending receipt of central assistance.

• Similarly, it has allocated ₹400 crore for railways, though that is a central subject.

• The most interesting story emerges from Uttar Pradesh. The state has been forced to revise its estimated receipts on account of its share in central taxes downwards by a massive ₹17,000 crore.

Way ahead:

- Unlike other states, this substantial reduction did not find mention in its budget speech, and was quietly slipped into one of the budget documents.

• Despite the transfers to states during the current fiscal year being revised to ₹11.87 trillion under the Union budget, such transfers are estimated to increase by more than ₹2 trillion to ₹13.90 trillion in the next fiscal year, which is perhaps unrealistic.

• Unfortunately, states have accordingly projected a substantial increase in funds to be received from the Centre and have planned their expenditure on that basis. These may need to be trimmed in the future.

Conclusion:

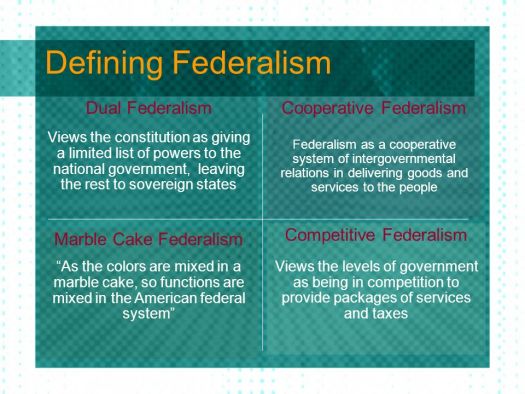

- Politics has trumped economics and the greater good thus far in India’s story of cooperative federalism. This needs to be fixed before it is too late.

• Greater transparency and stakeholder participation in the budget-making process of the Centre as well as states could go a long way in this regard, as also institutionalized mechanisms for better Centre-state coordination.

• Above all, political parties need to rise above their electoral mindsets and act in favour of the country’s greater good for India to realize the true potential of cooperative federalism.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS. https://triumphias.com/pages-all-courses.php