Relevance: Prelims: Polity: Governance

Why in news?

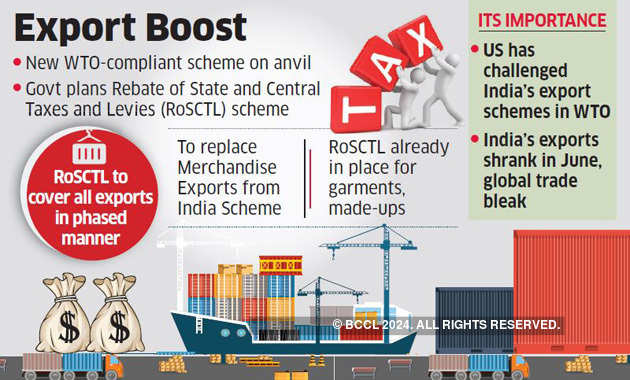

- The Cabinet approved the continuation of Rebate of State and Central Taxes and Levies (RoSCTL) for export of garments and made-ups from April 1, 2020 till the scheme is merged with Remission of Duties and Taxes on Exported Products (RoDTEP).

Key highlights:

- RoSCTL was offered for embedded state and central duties and taxes that are not refunded through goods and services tax.

- The government, had on March 13 approved RoDTEP, a scheme for exporters to reimburse taxes and duties paid by them such as value added tax, coal cess, mandi tax, electricity duties and fuel used for transportation, which are not getting exempted or refunded under any other existing mechanism.

- RoSCTL scheme for apparel and made-ups will be continued with effect from April 1, 2020 without any change in scheme guidelines and rates as notified by ministry of textiles till such time that the RoSCTL is merged with RoDTEP.

- As per the statement, continuation of RoSCTL beyond March 31, 2020 is expected to make the textile sector competitive by rebating all taxes/levies which are currently not being rebated under any other mechanism.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS. https://triumphias.com/pages-all-courses.php