Why in news?

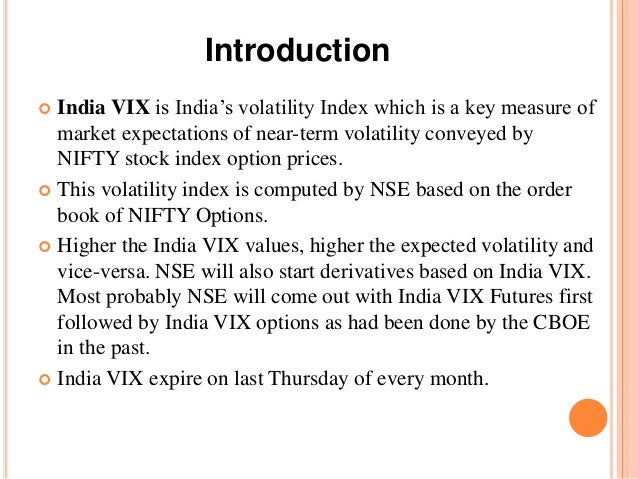

• India VIX is an index that serves as a measure of market expectation of volatility in the near term.

• Simply put, while volatility signifies the rate and magnitude of change in the stock price or index value, the movement in the VIX index reflects the overall market volatility expectations over the next 30 days.

• So, a spike in the VIX value means the market is expecting higher volatility in the near future.

Why do we have a VIX index?

• India VIX index is not the first of its kind in the world.

• The VIX index was first created by the Chicago Board Options Exchange (CBOE) and introduced in 1993 based on the prices of S&P 500 index.

• Since then, it has become a globally-recognised gauge of volatility in the U.S equity markets. The India VIX was launched with a similar intent in 2010 and is based on the computation methodology of CBOE though amended to align with the Indian markets.

• While derivatives contracts were also launched on India VIX, those never really registered any significant volume.

• Incidentally, the VIX value is among the important parameters that are taken into account for pricing of options contracts, which are one of the most popular derivative instruments.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS. https://triumphias.com/pages-all-courses.php