Relevance: Prelims/Mains: G.S paper III: Indian Economy: Banking

Context:

• The RBI has once again stepped in at the right time with measures that will reduce the cost of capital and ease the financial burden on businesses due to the extended lockdown.

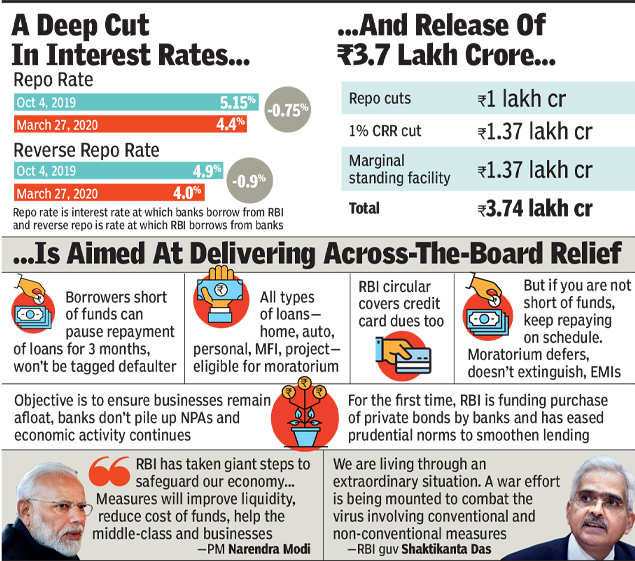

• With a repo rate cut of 40 basis points, the RBI has shaved off 1.15 percentage points from the rate chart in the 58 days since the lockdown began, bringing the repo rate down to 4% and the reverse repo rate to 3.35%.

Measures were taken by the RBI:

• The central bank may have played out its rate cut card, for now, it reserves some leverage for the future if economic conditions deteriorate even further.

• In fact, there are those who believe that the latest cut may be no more than a sentiment booster as economic activity is at its nadir and there are not many investment proposals on the anvil that may benefit from the lower interest rate.

• Existing borrowers may be the only beneficiaries of the rate cut at this point in time.

• That said, the RBI deserves a pat on the back for listening to feedback over some of its moves initiated earlier during the lockdown.

• Thus, the extension of the repayment moratorium on loans is a welcome measure.

• A large proportion of commercial borrowers have availed themselves of the moratorium but retail borrowers have not taken to it in a big way.

• Yet, going forward, there may be more opting for it given that the extended lockdown has left many a business in shambles and salaries have either not been paid or are being disbursed with delays.

Empathy:

• The RBI has also shown empathy by allowing accumulated interest on working capital loans to be converted into a term loan repayable by the end of this fiscal.

• Borrowers would otherwise have been faced with the daunting prospect of paying up their interest dues in one shot at the end of the moratorium period.

• The extended period given may however still not be enough as it will offer borrowers only about seven months from the end of the moratorium period during which they will have to crank up their businesses and service their loans.

• The RBI could have put off accumulated interest repayment by one year; it might well find itself in a situation where it is forced to offer another extension in the next few months.

• The increase in group exposure limit for banks to 30% from 25% will help large corporate borrowers who may find themselves handicapped in raising funds from the markets now.

• There was some disappointment in the markets that the RBI did not relax norms for loan restructuring by lenders.

Conclusion:

• The central bank has played its cards well here because there is no way of knowing the true extent of distress. Hence it will be difficult to propose the right restructuring norms.

• Chances are that this may well form part of the RBI’s next announcement.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS. https://triumphias.com/pages-all-courses.php