Relevance: Mains: G.S paper III: Economy

Context:

- The World Bank conducts an annual examination of about 200 economies in terms of ease of doing business.

• The result of the examination India improved its overall ranking by 14 spots to 63 on the list, and earned a place among the world’s top 10 ‘improvers’ in ease of doing business, for the third consecutive year.

• In terms of ‘resolving insolvency’, which reflects ease of exit from business, India’s ranking improved by 56 places to 52 from 108 the previous year.

Highlights of the examination by IBC:

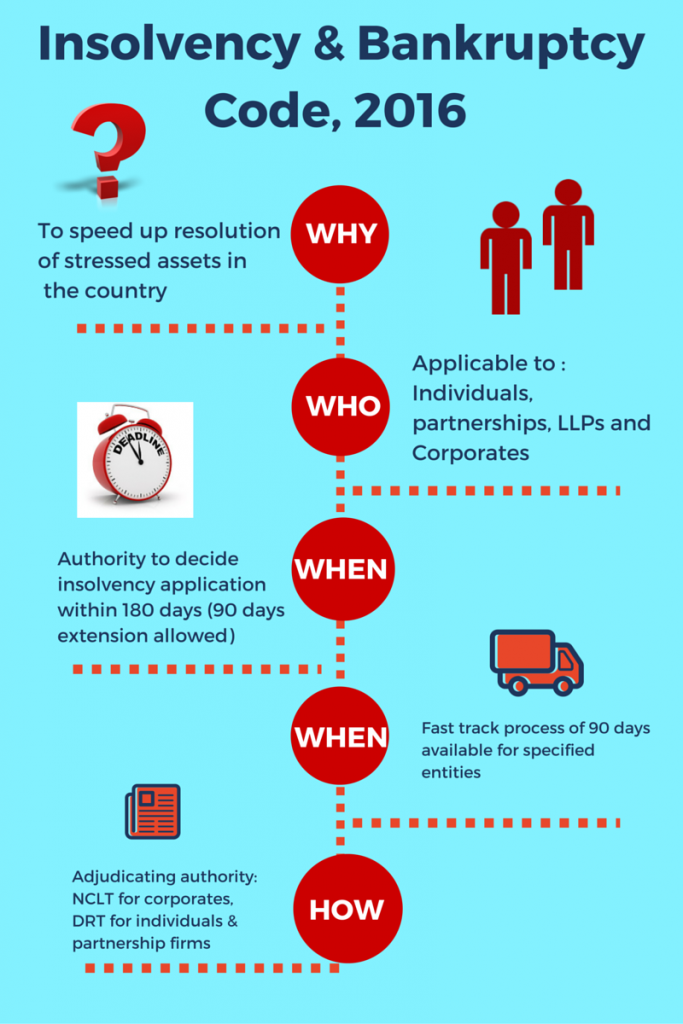

- The World Bank recognised that with the reorganisation procedure available, through the Insolvency and Bankruptcy Code, 2016 (IBC), companies have effective tools to restore financial viability, while creditors have better tools to successfully negotiate and have greater chances to realise the money.

• As a result, the overall recovery rate for creditors jumped from 26.5 cents on the dollar to 71.6 cents, and the time taken for resolving insolvency reduced significantly from 4.3 years to 1.6 years.

• India is now, by far, the best performer in South Asia on resolving insolvency and does better than the average for OECD high-income economies in terms of the recovery rate, time taken and cost of proceedings.

Insolvency framework:

- The World Bank measures the perception of stakeholders in respect of ‘resolving insolvency’ on two sets of indicators, namely, the strength of insolvency framework and the recovery rate.

• The strength of insolvency framework is a function of four indices relating to commencement of proceedings, management of firm’s assets, reorganisation proceedings and creditor participation.

• The World Bank considers it positive if an insolvency framework enables direct liquidation of a corporate debtor (CD).

• The IBC enabled the committee of creditors (CoC) to decide to liquidate a CD at any time.

• An amendment to the IBC in August 2019 has clarified that the CoC may decide to liquidate the CD at any time during the corporate insolvency resolution process (CIRP), even before preparation of information memorandum.

• The Supreme Court has reiterated in November 2019 that it is for the CoC to decide as to whether to rehabilitate or liquidate the CD.

• As a matter of practice, the adjudicating authority (AA) allows for liquidation as and when the CoC decides so. Even at the stage of application, the AA puts the CD (eg M/s GNB Technologies (India) Private Ltd in November 2019) under liquidation process, obviating the CIRP in the first instance.

• This is besides provision for direct voluntary liquidation under the IBC and liquidation under the company law.

• With regard to the management of the firm’s assets, the IBC facilitates continued operations of the CD during CIRP.

• The December 2019 amendment to the IBC mandates that a license, permit, registration, quota, concession, clearance or a similar grant or right given by the Central government, the State government, a local authority, sectoral regulator or any other authority constituted under any other law to a CD shall not be suspended or terminated on the grounds of insolvency.

• It also requires continuation of supply of goods and services which are critical to protect and preserve the value of the CD and manage the operations of such CD as a going concern.

• An amendment to the IBC in August 2019 mandates that a resolution plan approved by the AA is binding on the Central government, any State government and any local authority.

Resolution plan for corporate debtor:

- The IBC envisages a resolution plan for reorganisation of a CD as a going concern.

• This gave the impression that the CD must continue to exist, post-resolution, limiting the possibilities of resolution.

• Though the contours of a resolution plan are left to the imagination of the market, the amendment of August 2019 makes it explicit that a resolution plan may provide for restructuring of the CD, including by way of merger, amalgamation and demerger.

• The recovery rate, as per the World Bank methodology, is a function of time, cost and outcome of insolvency proceedings.

• While reviving ailing firms, the resolution plans have returned about 200 per cent of liquidation value for creditors. This means that the creditors got 200 while they could have got at best 100 minus cost of liquidation, if these CDs were liquidated.

• The outcome should improve with the amendment in December 2019 that releases the CD from the liability arising from an offence committed under the erstwhile management prior to the commencement of the CIRP.

Speed of process:

- The Supreme Court attributed some delay in the law’s functioning in November 2019.

• However, several contentious issues have been settled by the Supreme Court in the last year, bringing in certainty of the process and predictability of outcomes.

• In July 2019, the Bench strength of the AA has been substantially enhanced.

• An amendment to the IBC in August 2019 requires closure of CIRP in 330 days, including time spent on litigation.

• These have improved disposal by the AA significantly in the last two quarters.

• There has been considerable learning by every element of the ecosystem in the last three years.

• The resolution process is now institutionalised, standardised and professionalised, which should translate to reduced cost of process.

• The Graduate Insolvency Programme launched in July 2019 should take the insolvency profession to the next level.

• Given the efficacy of the IBC, it has become the preferred mode for the insolvency resolution of a CD. This explains huge rush of applications for insolvency resolution in the last three years, even though the stakeholders are being advised to use the Code as the last resort.

Way forward:

- The work has begun in right earnest to add several value-added features to insolvency framework.

• These include cross-border insolvency, group insolvency, individual insolvency, valuation profession, market for distressed assets, automation of loan contracts, resolvability of companies, etc.

• The authorities remain committed to address deficiencies arising from implementation of the IBC, in sync with the emerging market realities.

• India’s performance in resolving insolvency should improve further, though the road to success will always remain under construction.

For more such notes, Articles, News & Views Join our Telegram Channel.

Click the link below to see the details about the UPSC –Civils courses offered by Triumph IAS. https://triumphias.com/pages-all-courses.php