Relevance: Prelims/Mains: G.S paper III: Indian Economy: Inflation

Context:

- It is said that food inflation has made a comeback, both in India and globally.

• The Indian food inflation may be influenced by global price movements.

Analyzing the scenario in both India and World perspective:

- The UN Food and Agriculture Organisation’s (FAO) food price index is a measure of the change in international prices of a basket of major food commodities.

• With 2002-04 (100 points) as a base period to the index, it touched 182.5 points in January 2020, the highest since December 2014.

• Also, the year-on-year inflation rate based on this index has risen steadily from 1.13% in August 2019 to 11.33% for January 2020.

• This sharp surge in global food prices is reflected in trends in India.

• Consumer and wholesale food inflation rates for December 2019 were the highest since November 2013 and December 2013 respectively.

• Simply put, since October 2019, food inflation has made a comeback, both in India and globally.

Factors contributing to the inflation:

Local factors:

- While the recent rise in domestic food prices has been blamed largely on “local” factors,

• Poor rainfall during the monsoon season (June-July 2019)

• Too much of rainfall thereafter till about mid-November.

• This led to both reduced/delayed kharif sowings and damage to the standing crop at maturity/harvesting stage, some of it is also “imported”.

Foreign factors:

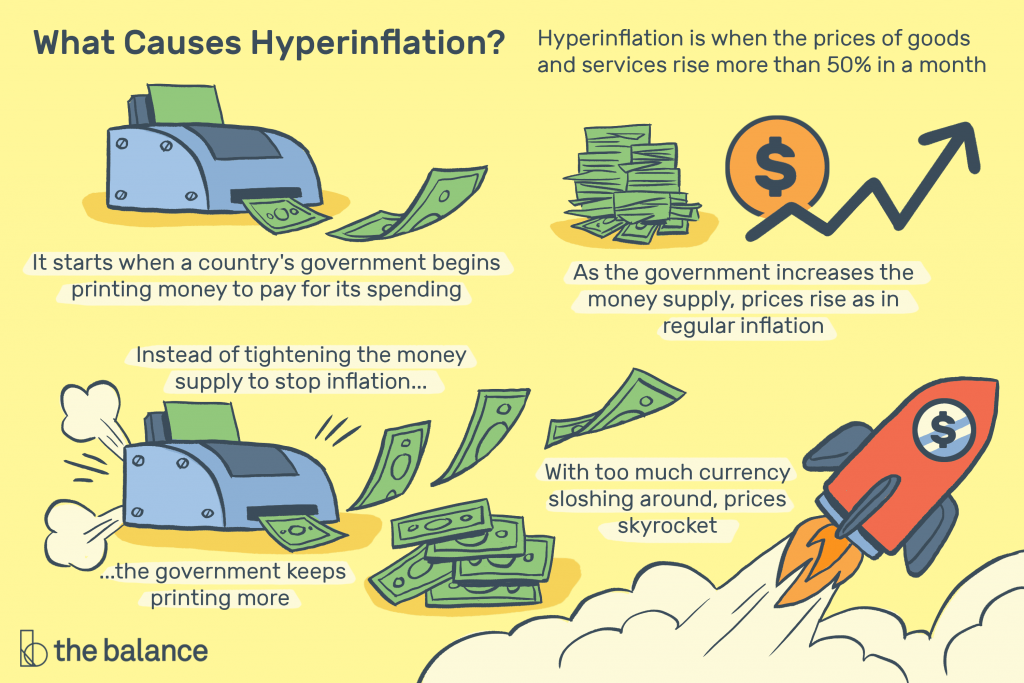

- Since India imports most of its edible oil, higher international prices would have been automatically transmitted to the domestic market.

• As global prices can be transmitted to the domestic market through exports, the government has foreclosed that possibility by restricting onion shipments since September 2019.

Period of divergence:

- The FAO food price index and the domestic consumer food price index (CFPI) inflation rates started moving in tandem from March 2018.

• They exhibited a significant divergence in the period prior to that.

FAO index:

- The FAO index peaked at 240 in February 2011, but remained at 200-plus levels until July 2014.

• Global prices crashed after that, and stayed low up to early 2016, with the FAO index dipping to 149.3 in February 2016.

Domestic food index:

- It also fell by early 2016, as lower global commodity prices reduced the demand for Indian farm exports, even as they made imports cheaper.

• However, the actual fall in domestic inflation took place after September 2016 which had more to do with domestic factors than global prices.

• Between August 2016 and October 2017, the FAO index inflation exceeded the corresponding CPFI rate.

Present situation:

- Both international and domestic food prices are showing signs of renewed hardening.

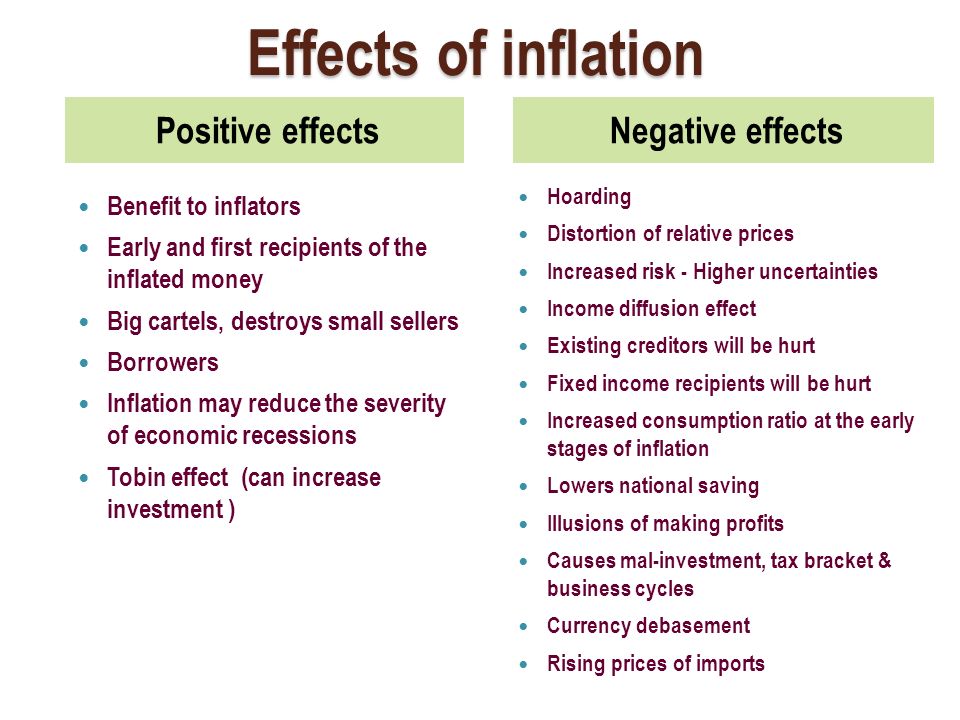

• So the question now is how sustainable this trend is. There are at least three bearish factors currently at play.

• The novel coronavirus epidemic that has reduced Chinese buying of everything like palm oil, milk powder, meat, etc from outside.

• The price of crude oil is another factor.

• The prospect of a bumper rabi (winter-spring) crop in India is the third one. The kharif harvest turned out to be not so good because of excess and unseasonal rain.

• Against these bearish factors are the relatively “bullish” factors.

• Global palm oil ending stocks this year are projected to be the lowest since 2009-10 and sugar is also expected to move into deficit.

• Supply tightness is being seen both globally and in India, even in milk.

• If Brent crude too, were to rally again, there could be uncertainty ahead.