Introduction

The formalisation of India’s economy remains a critical challenge as a significant portion of the workforce and enterprises continue to operate in the informal sector. While recent reforms have accelerated formalisation, persistent gaps hinder economic growth, tax compliance, and social security benefits for workers. This article explores the formalisation gap in India, its causes, consequences, and potential solutions.

Understanding Formalisation

Formalisation refers to the process of integrating businesses and workers into the regulated economy. This includes registration with government authorities, compliance with tax regulations, adherence to labour laws, and access to institutional credit.

According to the Economic Survey 2021-22, around 93% of India’s workforce remains informally employed, despite efforts like the implementation of the Goods and Services Tax (GST), digital payments, and social security schemes. The informal sector contributes nearly 50% to India’s GDP, highlighting its economic significance but also the challenges of transitioning to a fully formalised economy.

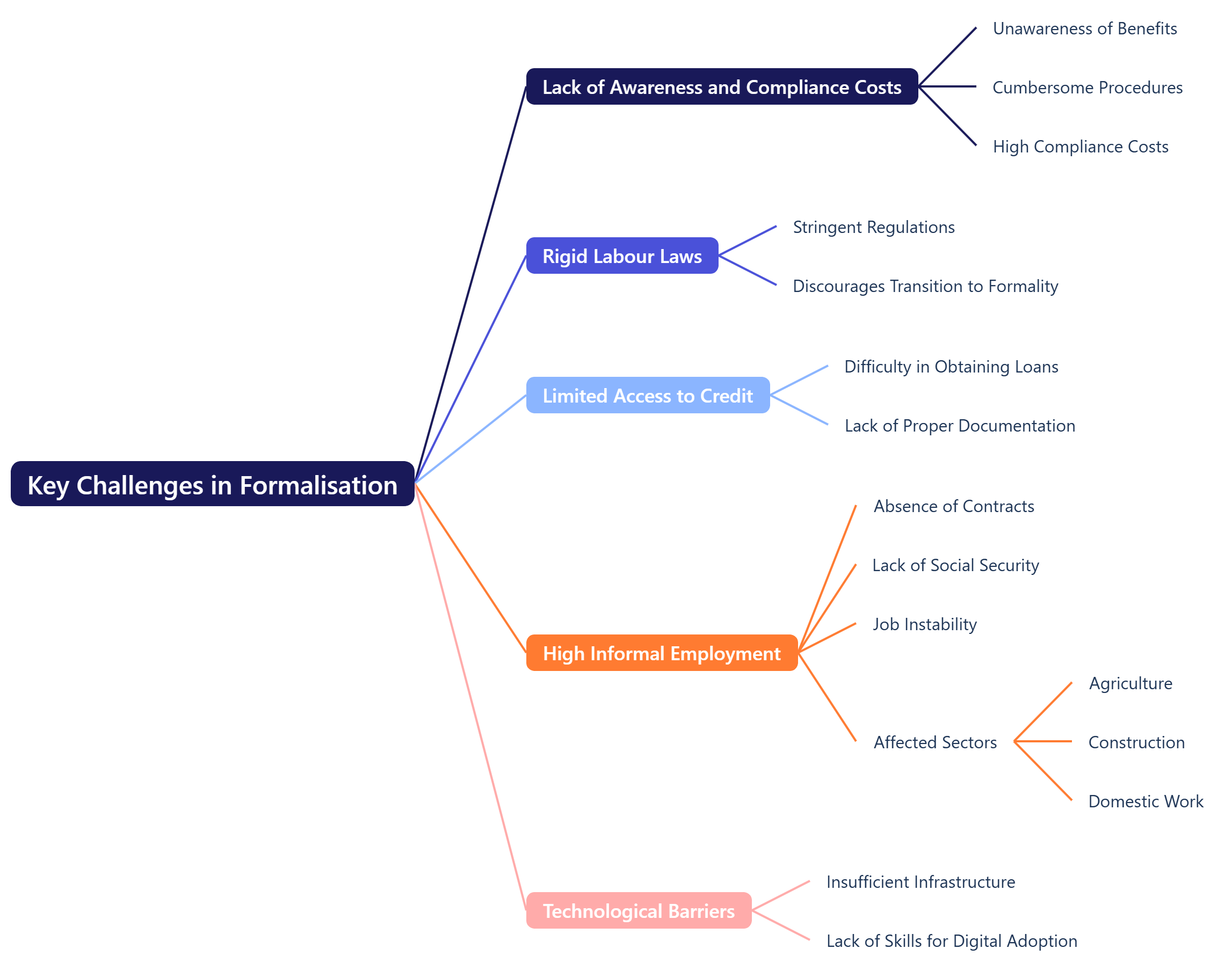

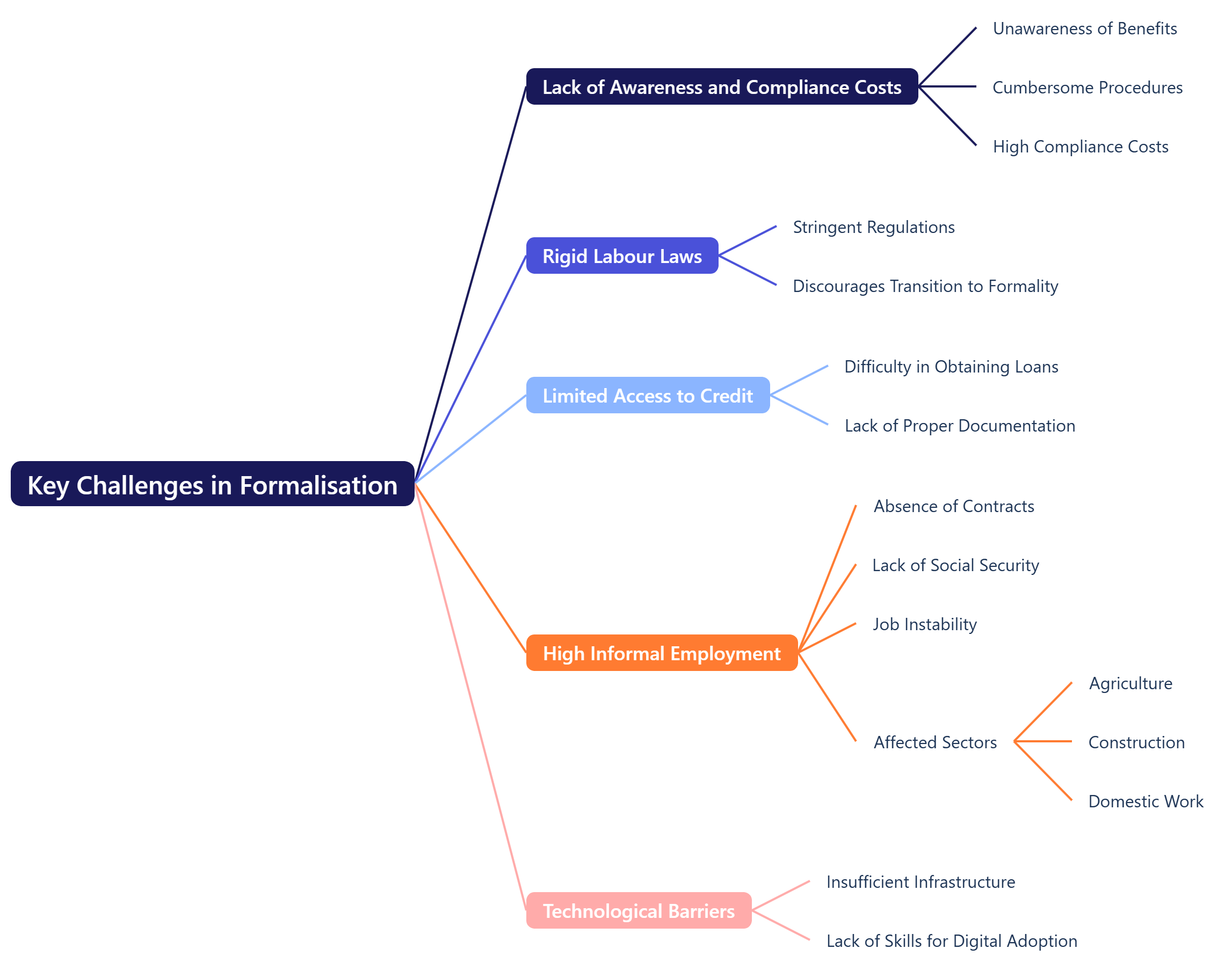

Key Challenges in Formalisation

- Lack of Awareness and Compliance Costs: Many small businesses and informal workers are unaware of the benefits of formalisation or find compliance procedures cumbersome and costly.

- Rigid Labour Laws: Stringent regulations discourage small businesses from transitioning to formal structures.

- Limited Access to Credit: Informal businesses struggle to obtain loans from formal financial institutions due to the absence of proper documentation.

- High Informal Employment: A majority of the workforce lacks written contracts, social security, and job stability, particularly in sectors like agriculture, construction, and domestic work.

- Technological Barriers: While digital platforms can enhance formalisation, many small businesses lack the necessary infrastructure and skills to adopt digital solutions.

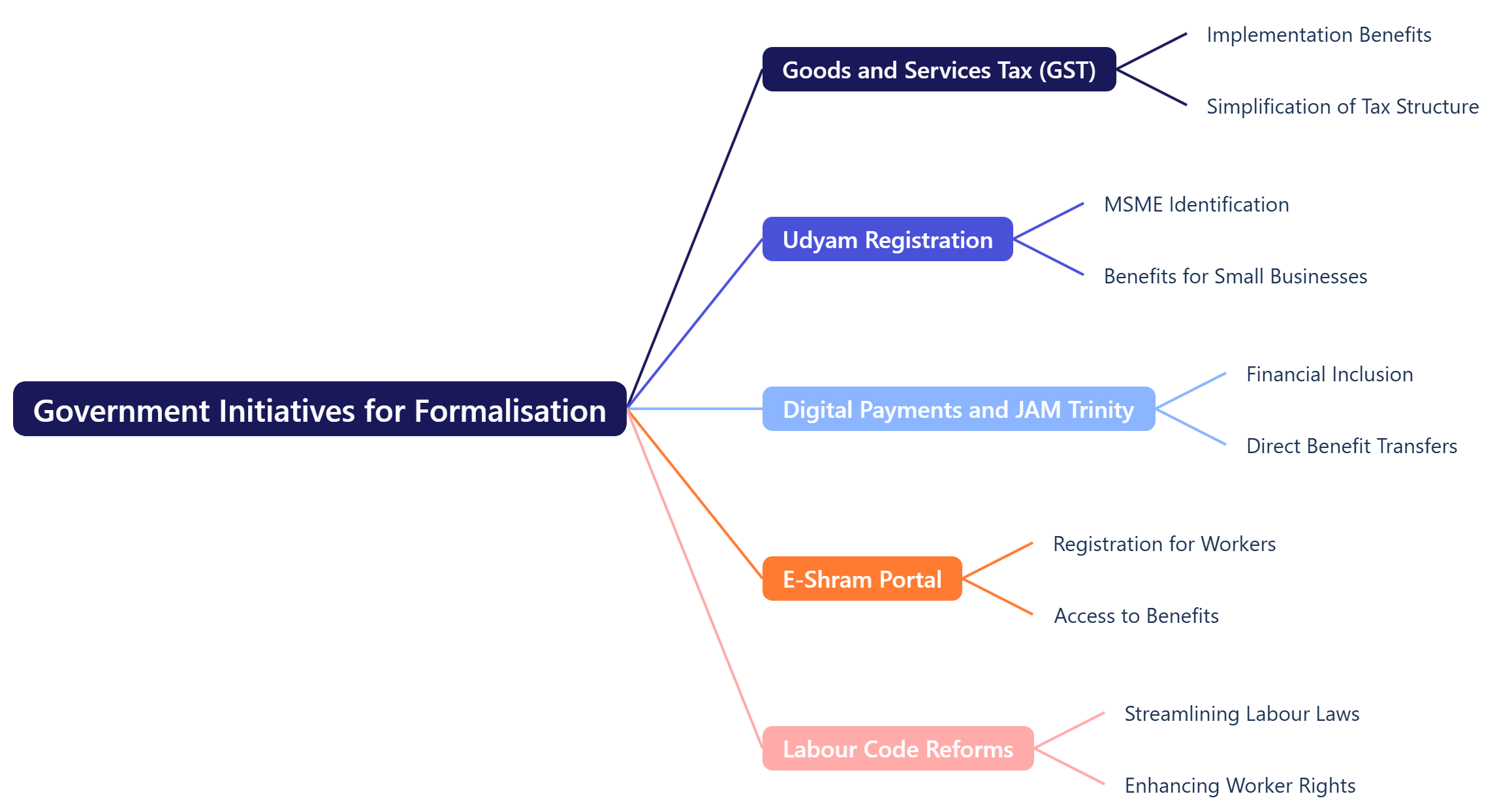

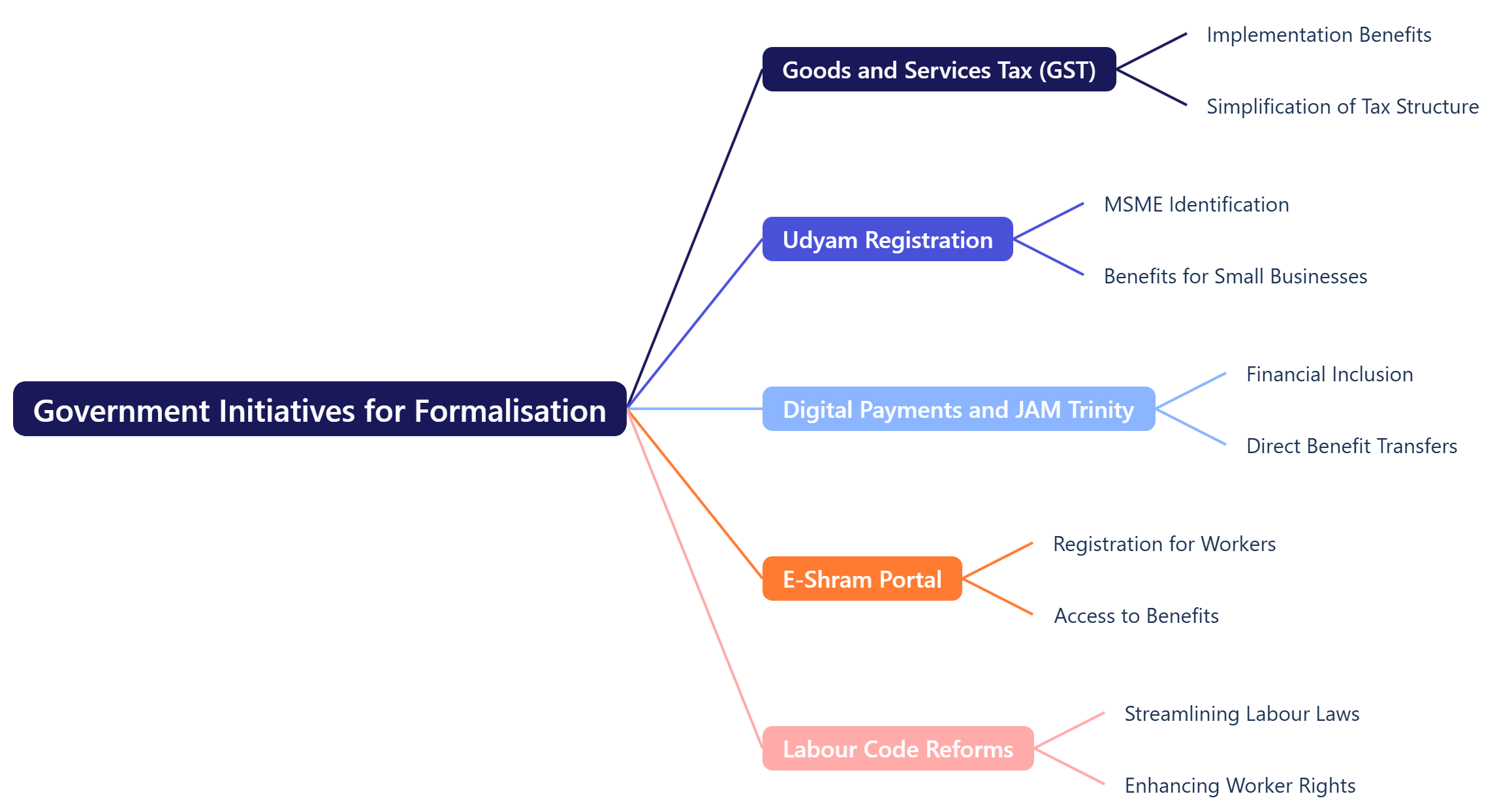

Government Initiatives for Formalisation

Several reforms have been introduced to bridge India’s formalisation gap:

- Goods and Services Tax (GST)

- Implemented in 2017, GST has significantly improved tax compliance by integrating businesses into a unified tax system. The number of registered businesses under GST crossed 1.4 crore in 2024, demonstrating progress in formalisation.

- Udyam Registration

- The Udyam portal simplifies registration for Micro, Small, and Medium Enterprises (MSMEs), facilitating access to credit and government incentives. As of 2024, over 2.5 crore MSMEs have registered, up from 1.3 crore in 2021.

- Digital Payments and JAM Trinity

- The Jan Dhan-Aadhaar-Mobile (JAM) Trinity has accelerated financial inclusion, bringing over 50 crore individuals into the formal banking system. Digital transactions via Unified Payments Interface (UPI) surpassed 12 billion in 2023, reducing reliance on cash-based informal transactions.

- E-Shram Portal

- Launched in 2021, this national database for unorganised workers helps extend social security benefits to gig and informal workers. By 2024, over 29 crore workers have registered, improving access to government welfare schemes.

- Labour Code Reforms

- The four new labour codes, yet to be fully implemented, aim to simplify regulations and expand social security for gig and platform workers, promoting their transition into the formal sector.

Impact of Formalisation

Formalisation benefits individuals, businesses, and the overall economy by:

- Expanding the Tax Base: Higher compliance increases government revenue, reducing reliance on indirect taxation.

- Enhancing Social Security: Employees in formal setups gain access to provident funds, health insurance, and job security.

- Improving Access to Credit: Formal businesses are more likely to receive loans and financial support, fostering entrepreneurship.

- Boosting Productivity: Compliance with labour laws leads to better working conditions, resulting in higher efficiency and economic output.

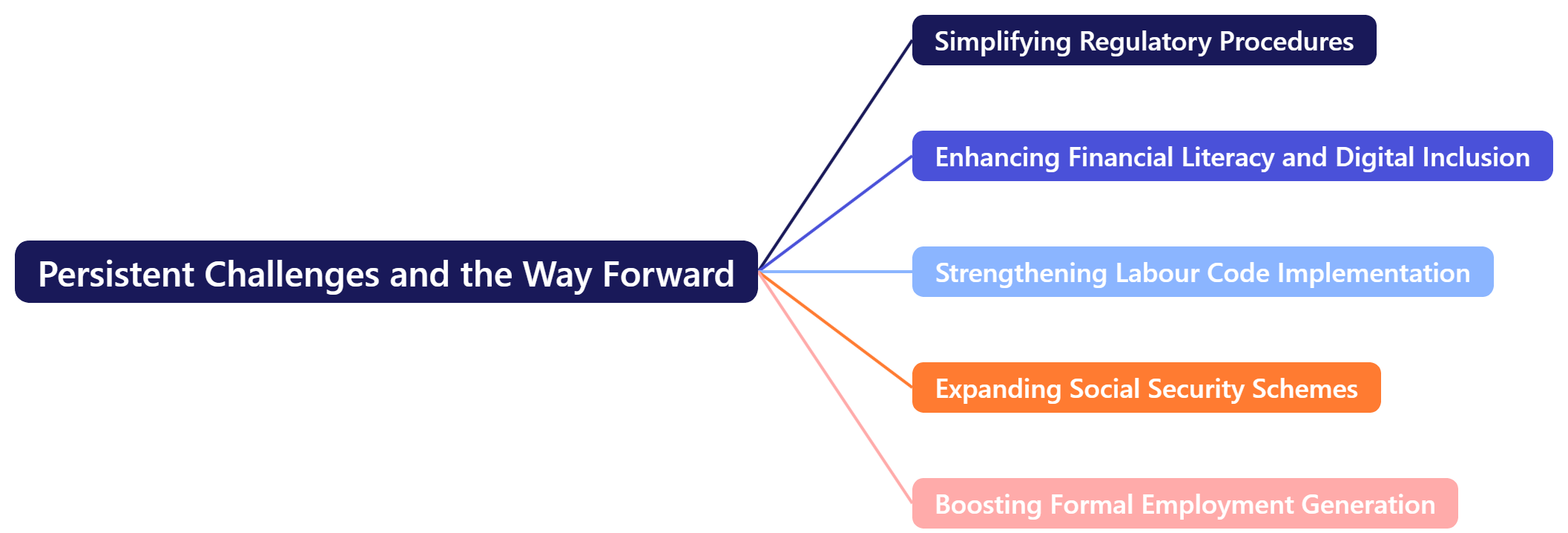

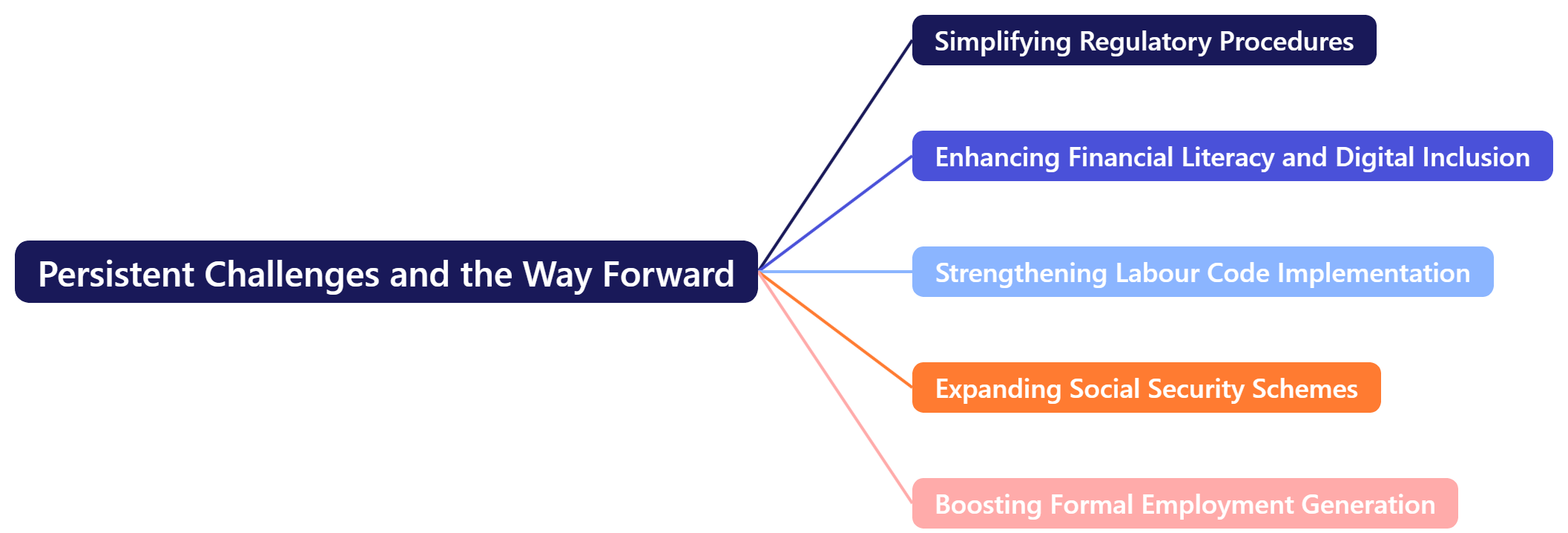

Persistent Challenges and the Way Forward

Despite progress, several gaps remain in India’s formalisation efforts. Addressing these requires a multi-pronged approach:

- Simplifying Regulatory Procedures

- Reducing bureaucratic hurdles and ensuring that compliance is not overly burdensome, particularly for small businesses and informal workers.

- Enhancing Financial Literacy and Digital Inclusion

- Expanding awareness campaigns on the benefits of formalisation and training small businesses to adopt digital payment systems.

- Strengthening Labour Code Implementation

- Accelerating the rollout of the new labour codes and ensuring their enforcement protects worker rights while incentivising businesses to transition into the formal economy.

- Expanding Social Security Schemes

- Strengthening schemes like Atal Pension Yojana (APY) and Pradhan Mantri Shram Yogi Maandhan (PMSYM) to provide retirement benefits and insurance coverage to informal sector workers.

- Boosting Formal Employment Generation

- Encouraging labour-intensive industries and skill development programs to integrate informal workers into structured employment.

Conclusion

India’s journey towards formalisation has made significant strides, yet challenges persist. While GST, digital payments, labour reforms, and MSME registration have improved compliance and financial inclusion, structural barriers continue to hinder progress. A sustained policy focus on simplifying regulations, increasing awareness, and expanding social security is essential to bridge India’s formalisation gap and drive inclusive economic growth.

The coming years will be crucial in determining whether India can successfully transition towards a fully formalised economy, ensuring greater economic stability and improved livelihoods for millions of informal workers.

|