Relevance: Mains: G.S paper II: Polity: Government schemes and policies

Context

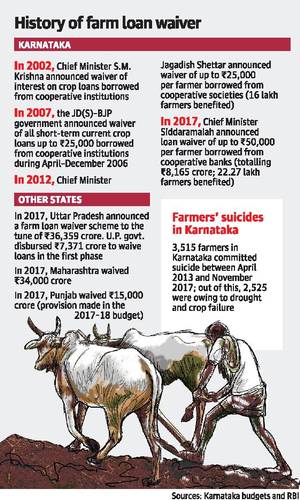

The Mahatma Jyotirao Phule Farm Loan Waiver Scheme announced by the newly-formed Maha Vikas Aghadi government in Maharashtra is the latest scheme that aims to waive off farm loans up to ₹ 2 lakhs.

Agrarian Crisis in India

- Farm distress is mainly caused by droughts, rising costs, inadequate crop prices and falling incomes.

- The crisis has also been caused by policies that focus on inflation targeting due to overt focus on the consumer and not on the producer.

- Also, there has been a change in the structure of agriculture. The increasing monetisation and mechanisation of agricultural operations and the shifts in cropping pattern towards cash crops and horticulture require more investments in marketing and storage infrastructure.

- The farmer has become more vulnerable to price movements and is increasingly falling into a debt trap.

- Declining prices of agricultural commodities and increase in price volatility have worsened the agrarian distress.

Issue of farm loan waivers

- With the politicisation of the farm crisis largely driven by electoral exigencies rather than any normative considerations, farm loan waivers have become a favoured policy choice of governments to address the agrarian distress.

- The farmers had demanded loan waivers to deal with increasing indebtedness and suitable mechanisms to ensure stable and remunerative prices for their produce, given that vulnerability to price movements and the incidence of falling into a debt trap have been high.

- While the loan waiver policy could work as a short-term measure given the extent of indebtedness of farmers, empirical studies suggest that loan waivers have not had any long-term beneficial impact.

- However, more sustained long-term interventions are required for the resolution of the deep-rooted agrarian distress, which has been the result of a long-term crisis situation prevailing in agriculture. Without structural changes, the crisis continues to recur over time.

Why farm loan waivers do not offer long term solution?

- Loan waivers cannot address the problems of rising costs and falling profitability owing to declining farm prices, which is the primary reason for the worsening of the agrarian crisis.

- Stagnant incomes and deceleration in agricultural output have characterised rural distress, but the entire rural economy has been afflicted by a severe decline in demand, including the non-farm sector.

- The deceleration in the unorganised sector has led to growing unemployment and a decline in rural demand.

Negative Impacts of farm loan waivers

- Various studies suggest that loan waiver policies not only benefit institutional borrowers but also tend to disproportionately benefit better-off farmers.

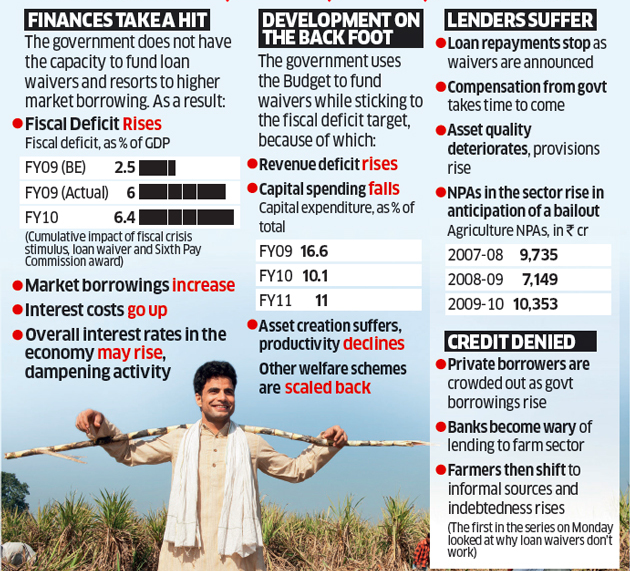

- This will lead to a moral hazard among eligible farmers with recurring loan waivers, and erode the rural credit delivery system, apart from adversely affecting banks that are already saddled with non-performing assets.

- Further, loan waivers pose a drain on the financial resources of the government, which would adversely affect public investments in agriculture, and is therefore not viable in the long term.

Way Forward

- Since loan waivers are short term solutions, there is a need for better policy thinking and targeting of such schemes.

- This calls for a proper implementation of carefully designed loan waiver schemes that ensure universal coverage for marginal, small and medium farm-size holders, while also covering both formal and informal sources of debt.

- The Kerala State Farmers’ Debt Relief Commission, operational since 2006, offers a model that could be used to design a comprehensive and inclusive loan waiver scheme.

- To alleviate the agrarian crisis following measures can be considered as well:

-

- Policy measures to raise productivity

- Reduce input and cultivation costs

- Offer remunerative prices

- Ensure assured procurement of output

- Consolidate landholdings, expand access to institutional credit

- Enhance public investment for rural and agri-infrastructure

- Institute effective crop-insurance programmes

- Promote agro-based industries

- Other requirements are investments in improving access to better technology, farm mechanization, research and extension programmes, and storage and warehousing infrastructure.

The Kerala State Farmers’ Debt Relief Commission

- This permanent body consisting of agricultural experts, farmer representatives and former judges considers individual applications for restructuring and negotiating debts between farmers and lenders.

- The advantage of such a commission is that the support provided to farmers is disassociated from the electoral cycles.