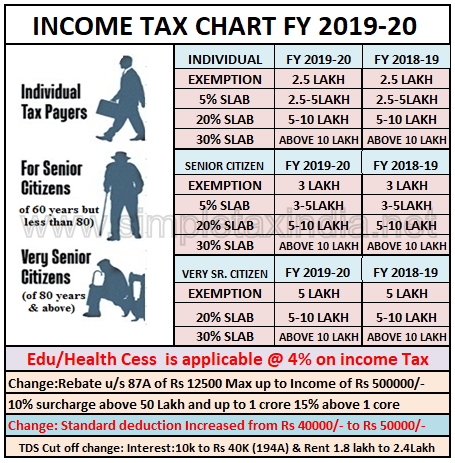

Relevance: Mains: G.S paper III: Economy: Taxation

Context:

- An amendment is proposed to the Income Tax Act in the Finance Bill or the Union Budget 2020.

• It says that all Indians who are working abroad and not paying any income tax in those countries would be liable to pay tax in India.

What is the response?

- Kerala Chief Minister wrote to Prime Minister recording his government’s disagreement with the provision.

• He said that the proposal would hurt those who toil and bring foreign exchange to the country.

What is the existing law?

- Two parameters determine whether India levies income tax on an individual.

• Residential status: In India, residency requires a person to actually live in the country for a specified number of days in a year.

• The Source of the Income: It is the country where the income is being generated.

• For a resident Indian citizen, the income tax law applies to that person’s worldwide income and such a resident Indian is required to pay tax on all of it.

• But for a non-resident Indian, the income tax law applies only to the income earned from within India.

• This difference between residents being taxed on their global income and non-residents being charged only on their Indian income lies at the heart of the confusion.

What is the amendment proposed by the government?

- The proposed amendment to the IT Act has three parts.

• Number of Days: The number of days that an Indian citizen can stay in India without becoming a resident is cut from 182 to 120.

• The Memorandum to the Budget said this provision was being misused.

• NOR category: The Memorandum has carved out the “Not Ordinarily Resident (NOR)” category.

• This status ensures that an individual who isn’t ordinarily a resident isn’t taxed as a resident, just because he spends more than specified number of days in India during a particular year.

• The amendment states that an NOR would be someone who has not been a resident of India for seven of the past 10 years.

• Under the existing law, it is nine out of the past 10 years.

• The Confusion: This amendment said that an Indian citizen who isn’t liable to tax in any other country or territory shall be deemed to be resident in India.

Arising problem with this:

- The amendment tries to tax non-residents as residents.

• This led to panic because, in the absence of clarifications, all non-residents working in tax-free jurisdictions concluded that all their income in there will now attract the Indian income tax rate.

• Apart from the likely harassment, this undermined the whole point of people leaving their homes in India to work in tax-free jurisdictions.

Way ahead:

- The government has clarified that its intention isn’t to target bona fide workers.

• It says it wants to catch tax evaders who game the residency provisions to evade all taxes.

• It says that the tax laws should not encourage a situation where a person is not liable to tax in any country.