|

Despite constitutional provisions, Panchayats continue to struggle with severe financial constraints. Limited fiscal devolution, over-reliance on centrally controlled schemes, and inefficient fund utilization weaken their financial autonomy.

Institutional challenges such as poor tax collection capacity, lack of borrowing authority, and inadequate financial transparency further undermine their effectiveness in local governance.

Evolution of Democratic Decentralization in India

Overview:

Democratic decentralization in India has undergone significant transformation, progressing from colonial-era local administration to constitutionally mandated self-governance structures. The 73rd and 74th Constitutional Amendments (1992) marked a milestone by granting legal recognition to Panchayati Raj Institutions (PRIs) and Urban Local Bodies (ULBs).

Early Developments in Local Governance (Pre-Independence Era)

Even under British rule, local self-governance was recognized as an administrative necessity, though it remained highly centralized and limited in scope.

Key Milestones in Pre-Independence Decentralization:

- 1882 – Resolution on Local Self-Government: Introduced by Lord Ripon, this laid the groundwork for municipal governance in India, advocating greater autonomy for local bodies.

- 1907 – Royal Commission on Decentralization: Recommended strengthening rural governance through village panchayats, but its implementation remained weak.

- Constitutional Debates on Decentralization (1948): While Mahatma Gandhi promoted Gram Swaraj (self-rule) as the foundation of democracy, B.R. Ambedkar expressed concerns about panchayats being dominated by powerful castes. As a result, local governance was included in the Directive Principles of State Policy (Article 40) rather than as a mandatory provision.

Post-Independence Developments in Democratic Decentralization

Phase 1: Early Reforms and the Three-Tier Panchayati Raj Model (1950s-1970s)

- 1957 – Balwant Rai Mehta Committee: Recommended a three-tier Panchayati Raj system with elected bodies at the village, block, and district levels, leading to PRIs being established in several states by 1959.

- 1963 – K. Santhanam Committee: Proposed limiting taxation powers for PRIs and suggested forming State Panchayati Raj Finance Corporations to strengthen their financial autonomy.

- 1978 – Ashok Mehta Committee: Identified bureaucratic resistance, political interference, and elite control as major challenges. Recommended districts as the primary administrative unit of governance. Some states, such as Karnataka, Andhra Pradesh, and West Bengal, implemented reforms, but overall decentralization remained incomplete, with state governments retaining significant control.

Phase 2: Strengthening Local Governance (1980s-1990s)

- 1985 – G.V.K. Rao Committee: Called for greater autonomy for PRIs and emphasized the role of Block Development Offices (BDOs) in rural development planning.

- 1986 – L.M. Singhvi Committee: Advocated constitutional recognition for PRIs and emphasized the Gram Sabha as the foundation of grassroots democracy.

- 1992 – The 73rd and 74th Constitutional Amendments: Provided constitutional status to rural and urban local governance, introducing mandatory elections, reservations, fiscal devolution, and planning responsibilities for local bodies.

These amendments marked a turning point in India’s governance structure, reinforcing democratic decentralization and empowering local self-governing institutions.

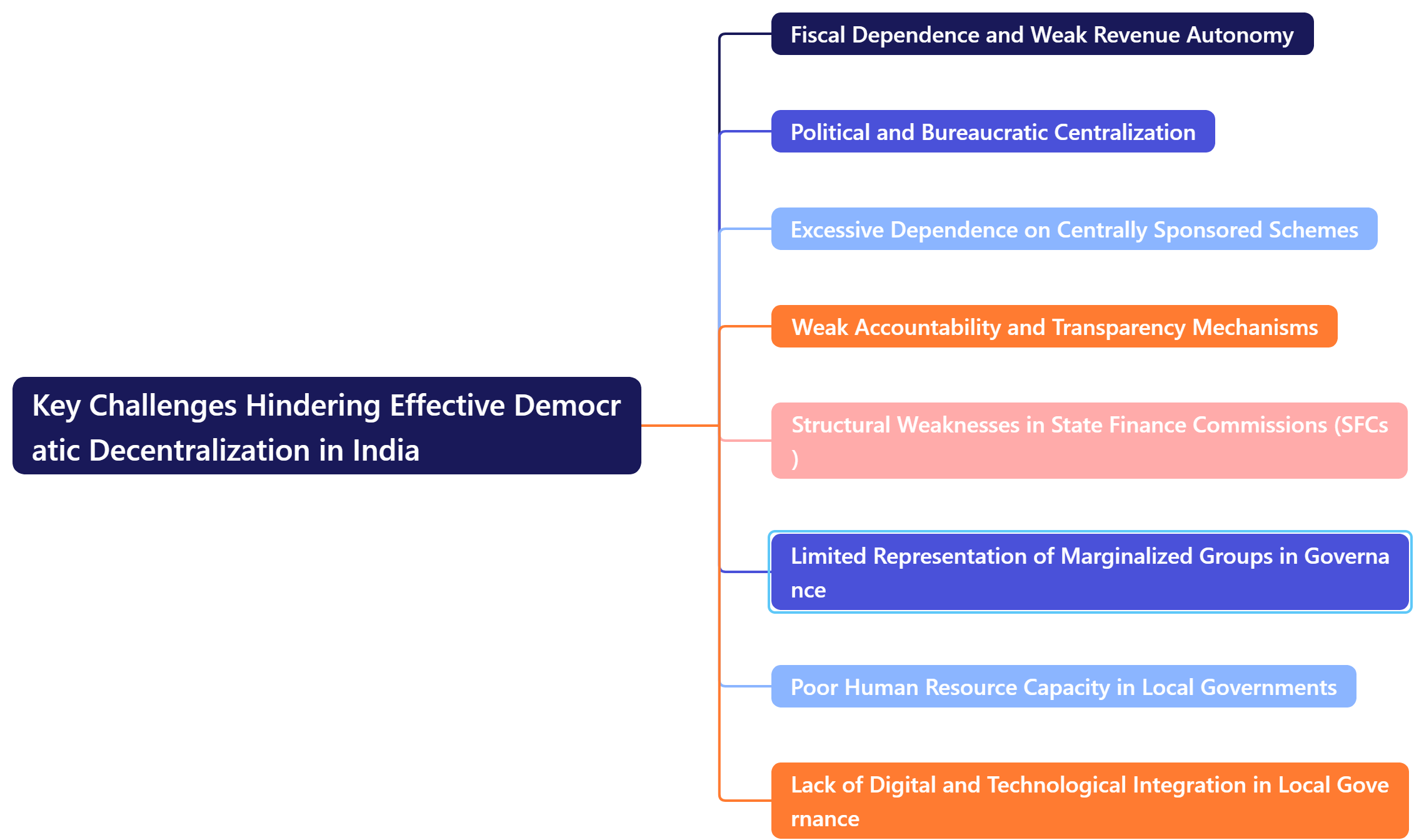

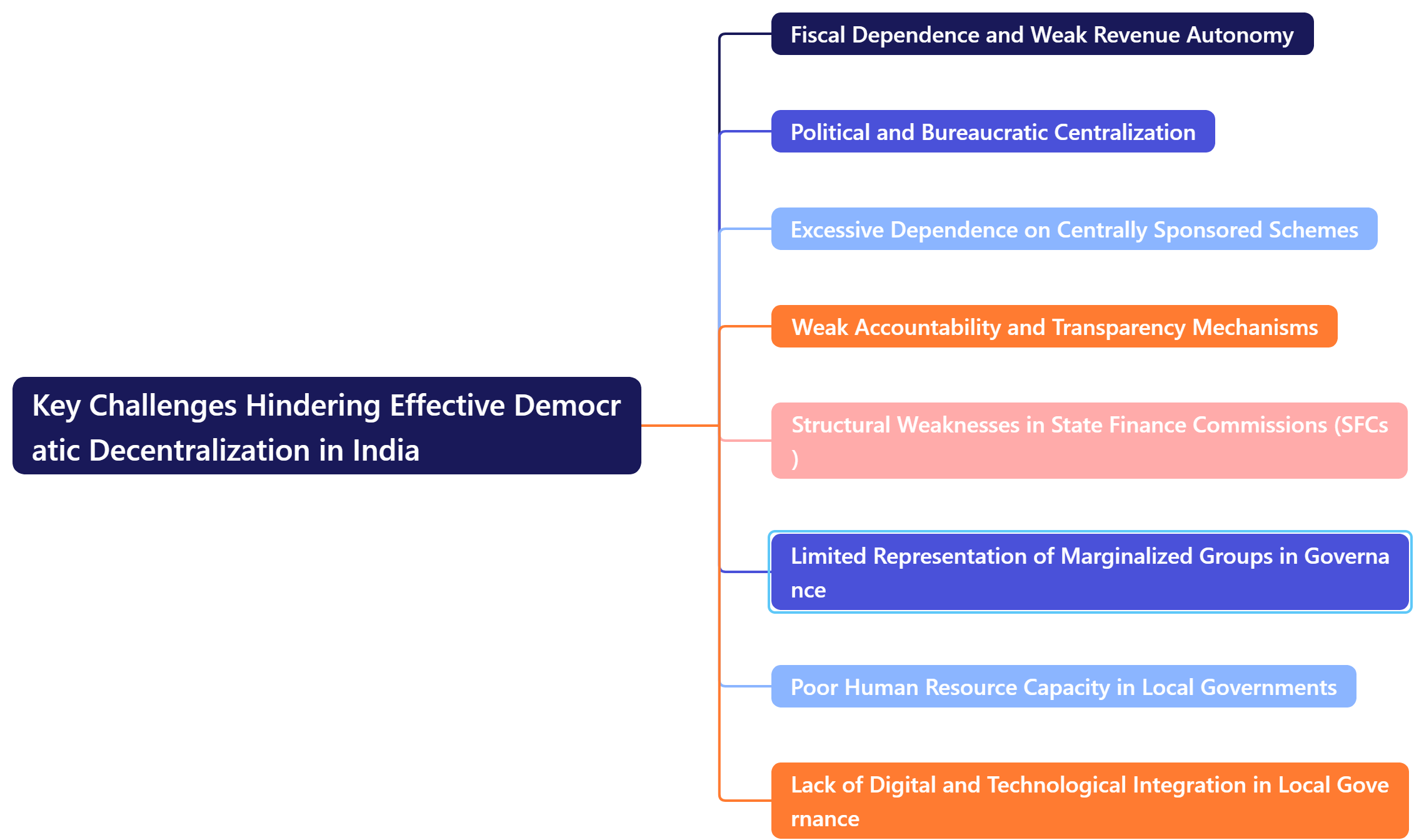

Key Challenges Hindering Effective Democratic Decentralization in India

- Fiscal Dependence and Weak Revenue Autonomy

Panchayats and Urban Local Bodies (ULBs) lack financial independence, relying heavily on unpredictable state and central transfers, limiting their ability to plan and implement projects efficiently.

- Weak own-source revenue generation, inefficient tax collection mechanisms, and state control over key revenue streams further weaken their financial capacity.

- State Finance Commissions (SFCs) are mandated to recommend fiscal devolution every five years, yet their formation is often delayed, and recommendations remain unimplemented.

- The 2024 “Status of Devolution to Panchayats in States Index” shows that own-source revenue accounts for just 5-10% of Panchayat expenditure.

- An RBI report indicates that although urban areas generate 60% of India’s GDP, municipal corporations receive only 0.6% of GDP in revenue.

- Political and Bureaucratic Centralization

Despite constitutional recognition, actual authority remains concentrated with state governments, reducing local bodies to mere implementing agencies for centrally and state-sponsored schemes.

- The transfer of 29 subjects under the 11th Schedule remains inconsistent, as states hesitate to relinquish control, restricting Panchayats’ decision-making power.

- This creates a structural contradiction—local governments are held accountable for service delivery but lack the autonomy to make decisions effectively.

- District Planning Committees (DPCs) exist but remain largely ineffective.

- Excessive Dependence on Centrally Sponsored Schemes

Local governments lack discretionary spending power since funds are mostly tied to centrally designed schemes, reducing their ability to address local needs.

- The mismatch between local priorities and centrally dictated projects leads to inefficiencies and resource underutilization.

- For instance, PMAY-G (Pradhan Mantri Awas Yojana – Gramin) was launched in 2016 to provide rural housing, yet 41% of funds remain unutilized due to delays, slow construction, and land availability issues.

- Weak Accountability and Transparency Mechanisms

Local governance suffers from poor financial accountability, lack of independent audits, and limited public participation in decision-making.

- Corruption and reluctance to impose taxes for electoral gains weaken Panchayat finances, while opaque decision-making undermines democratic decentralization.

- The RBI report highlights that tax revenue in Panchayats is just 1.1%, and non-tax revenue stands at 3.3% of total funds.

- Structural Weaknesses in State Finance Commissions (SFCs)

State governments frequently delay forming SFCs, and even when established, their recommendations are often ignored or not implemented effectively.

- Unlike the Central Finance Commission, most states fail to uphold the constitutional obligation of forming SFCs at regular intervals.

- The 15th Finance Commission (2021-26) noted that only nine states had constituted their 6th SFC, even though it was due in 2019-20 for all states.

- Limited Representation of Marginalized Groups in Governance

While reservations exist for women, Scheduled Castes (SCs), and Scheduled Tribes (STs) in local bodies, their representation remains largely symbolic, with decision-making power often controlled by dominant social groups.

- Women sarpanches and councilors frequently experience proxy representation (Pradhan Pati), where male family members exercise control over governance.

- Lack of training, financial independence, and institutional support weakens their actual participation in governance.

- A 2023 government panel recommended strict penalties for husband proxies in Panchayats, yet the practice remains widespread.

- Poor Human Resource Capacity in Local Governments

Local bodies face a severe shortage of trained personnel, with critical administrative functions still controlled by state-appointed officers.

- The absence of dedicated technical staff for planning, financial management, and service delivery hampers governance efficiency.

- Elected representatives often lack the training and expertise to manage governance effectively.

- A 2020 report found that District Planning Committees are non-functional in nine states, and failed to prepare integrated plans in 15 states.

- In many cities, staff vacancies against sanctioned posts stand at nearly 30%.

- Lack of Digital and Technological Integration in Local Governance

Most local bodies lack adequate digital infrastructure, limiting transparency, efficiency, and citizen engagement.

- While some states have introduced e-Governance initiatives, their uneven implementation creates gaps in service delivery.

- Over 40% of gram panchayats do not report digital attendance.

- 2021 Lok Sabha data revealed that over 25,000 villages in India still lack internet connectivity.

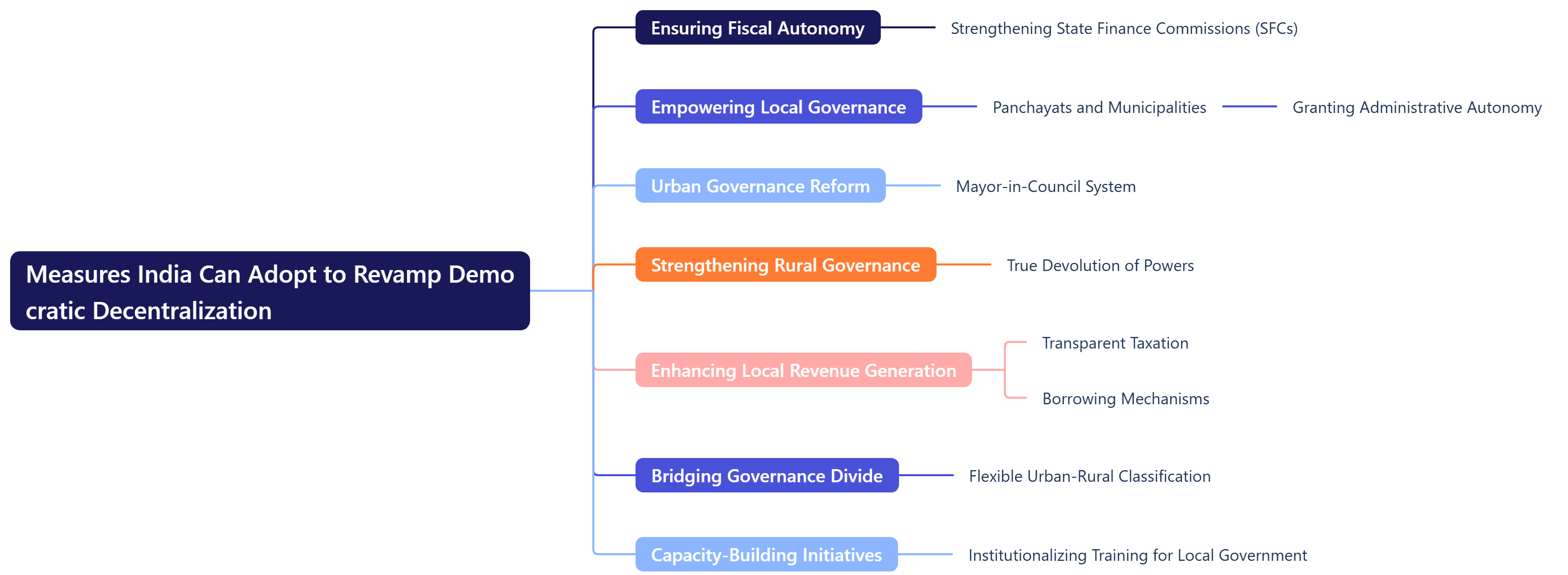

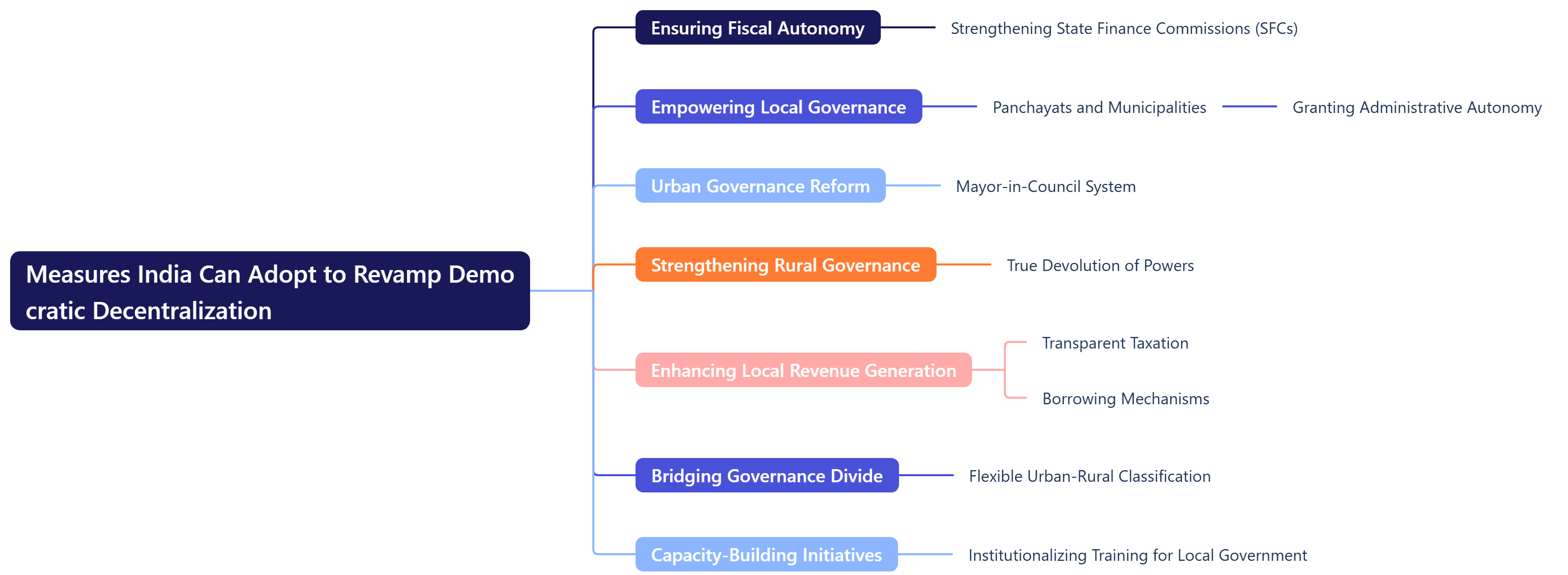

Measures India Can Adopt to Revamp Democratic Decentralization

- Ensuring Fiscal Autonomy by Strengthening State Finance Commissions (SFCs)

A predictable and transparent fiscal devolution mechanism is crucial for effective local governance.

- States should conduct comprehensive activity mapping for all subjects under the Eleventh and Twelfth Schedules and align financial devolution accordingly.

- Local governments must be granted greater tax autonomy, including improved property tax assessment and professional tax collection mechanisms.

- The Second Administrative Reforms Commission (ARC) recommends expanding and diversifying the revenue base of local governments to ensure financial sustainability.

- Empowering Panchayats and Municipalities with Administrative Autonomy

Local governments should have the authority to recruit personnel and regulate service conditions to enhance efficiency and accountability.

- The requirement for state approval of local budgets should be abolished, ensuring locally elected bodies have full control over their financial planning.

- Independent secretariats with trained personnel should be established for Panchayats and Urban Local Bodies (ULBs) to strengthen local governance.

- Reforming Urban Governance Through a Mayor-in-Council System

The current municipal governance structure, where executive powers are split between mayors and commissioners, creates inefficiencies and accountability gaps.

- A directly elected Mayor with a fixed tenure and executive authority can improve governance and public accountability.

- The Mayor-in-Council system, as recommended by the 2nd ARC, will streamline decision-making and enhance municipal efficiency.

- Municipal bodies should leverage land banks to generate revenue, reducing financial dependence on state governments.

- The 2nd ARC recommends that municipalities be granted full autonomy over their functions with a transparent taxation framework.

- Strengthening Rural Governance Through True Devolution of Powers

A mandatory activity mapping exercise should ensure a clear delineation of responsibilities at each governance level.

- Gram Panchayats should be of an appropriate size to function effectively and deliver public services efficiently.

- In tribal areas, the Panchayats (Extension to Scheduled Areas) Act, 1996 (PESA) should be fully implemented to empower traditional governance structures.

- Enhancing Local Revenue Generation Through Transparent Taxation and Borrowing

Local governments should be granted greater borrowing powers with regulatory safeguards to maintain fiscal discipline.

- Transparent property tax assessment and streamlined professional tax collection can improve local revenue generation.

- Municipal bonds and pooled financing mechanisms (e.g., Indore Model) should be encouraged to diversify revenue sources and fund urban infrastructure.

- The 2nd ARC recommends that municipalities be given full financial autonomy, with enhanced borrowing capacities.

- Bridging the Urban-Rural Governance Divide with Flexible Classification

The rigid urban-rural classification system leaves many peri-urban areas without proper governance structures.

- A dynamic classification system should be introduced, allowing peri-urban areas to transition smoothly from Panchayats to Municipalities.

- Governance should be service-centric rather than classification-centric.

- Metropolitan Planning Committees (MPCs) and District Planning Committees (DPCs) should be strengthened to address cross-jurisdictional challenges.

- The Ashok Mehta Committee recommended a two-tier governance structure with stronger financial and functional autonomy for local bodies.

- Institutionalizing Local Government Capacity-Building and Training

Local representatives often lack the necessary training and expertise to manage governance functions effectively.

- Establishing Local Governance Training Institutes (LGTIs) in every state can provide continuous capacity-building for elected representatives and officials.

- E-Governance and digital tools should be integrated into local administration to enhance efficiency and transparency.

- The G.V.K. Rao Committee recommended that local governments be empowered with adequate administrative and technical expertise.

For effective democratic decentralization, India must focus on fiscal strength, functional autonomy, and fair representation.

- Strengthening local revenue generation is crucial to reduce dependency on state and central transfers.

- Granting genuine administrative powers will enable Panchayats and municipalities to function independently and efficiently.

- Ensuring inclusive governance will empower marginalized communities and enhance grassroots democracy.

A forward-thinking approach should integrate digital governance, financial independence, and active citizen participation to create a robust and accountable local governance system.

|

One comment